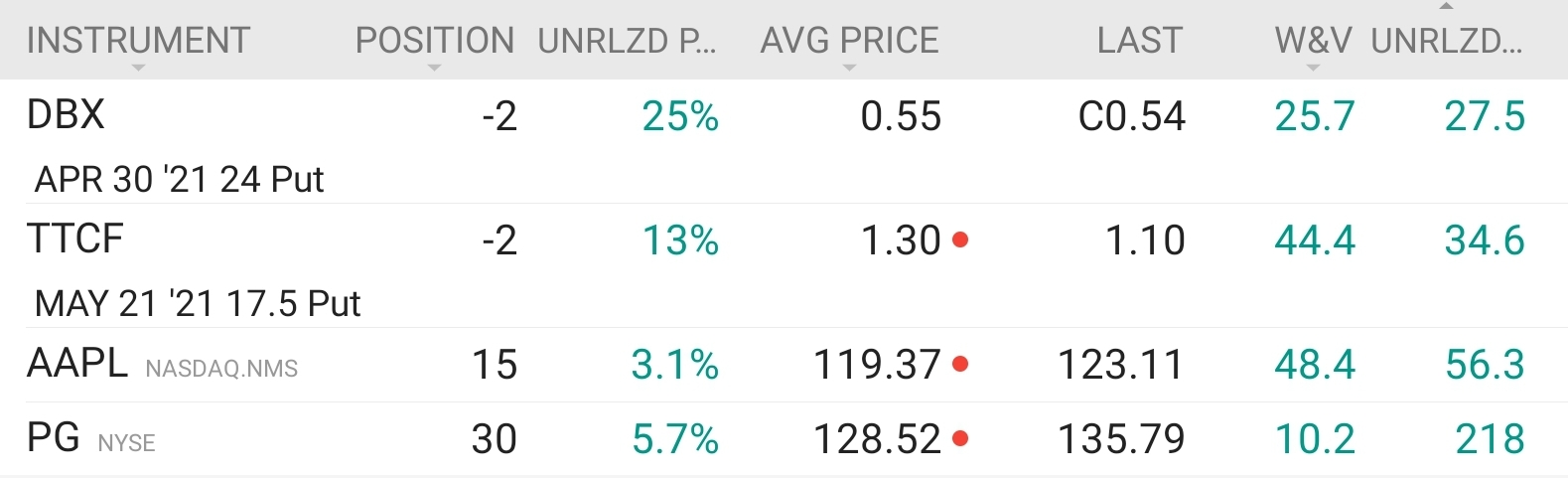

Want to wait till they are atleast +50/80%

Delta shows that there is 70% chance the option contracts will expire worthless. But why risk is for the last few pennies.. Theta decay is slowing down at the very end. First it goes faster but when at the last few days it slows down. Waiting for KO and MO to come down now to sell 1 PUT option each. When i have a $40.000 account, i am going to sell weekly Apple put options, which has great volume and produce nice returns. Right now i have almost $20000. Selling options is higly scalable on market leaders like AAPL, FB, WMT, MSFT, JPM ect. But for a small account 20/70% a year is not much yet. My account will grow over time. My goal is to hit $50k end this year from a mix of strategies, swing trading, dividend investing, option selling and daytrading and also going to deposit $500/1500 each month to speed things up even faster.

Join now or log in to leave a comment