My first month of trading has become the most educational month in my entire trading career. I started trading blue chip stocks in the spring of 2015. Ended up losing 15K in the first 18 months. Then I came across Timothy Sykes on Facebook and decided to get more interested in penny stocks. I knew my biggest problem was getting out of losing positions.

Started this month with a 10% gain on NVFY. However after my losses on BTUUQ and DRWI (see previous blog post) I thought I had learned something after I analysed the crap out of it the entire weekend. However, I did get cocky again and lost another 10% of my account on UNIS. During this time I was also traveling for my current day job. This all did not help me staying focused on the stock market and what I was doing. I thought I could combine traveling with trading, but this turned out to be a disaster. In the next 2 weeks I probably lost another 30% of my account due to stupid rookie mistakes. I wonder if I would have made those mistakes if I wasn't traveling.

After analysing my first month of trading and posting my trades here on Profit.ly I decided to make a spreadsheet and see where my biggest mistakes came from. I used to analyse my trades right after I made them and then pretty much forget about them the next day or a few days later. Right now I have analysed all of my trades that I made in the last 4 weeks and came to a conclusion: I am not picky enough on the sectors I trade, I am not patient enough to a stock at the price I really want, but rather jump in to make sure I am in the stock, I do not cut losses quick enough (however I have gotten better at it after BTUUQ, DRWI and UNIS) and possible the biggest mistake is OVERTRADING!!!!

When I started trading penny stocks and posting my trades here on Profit.ly, I told myself to make a maximum of 12 trades per month. However, after reviewing my first month, I have made 19 trades!!! 19 trades of which 3 Biotech stocks, 2 Energy stocks and 1 Financial stock. Stocks of which I was taught in Tim Sykes's DVD How To Make Millions not to trade!!! I can get frustrated with myself just reviewing my spreadsheet. The frustration comes from being cocky at the time I take a trade. I am not being a sniper, I am not picky enough, I am not trying to be the "retired trader". This is I think the main reason of why I have these big losses.

Anyway, it's not all that bad on every trade. Sometimes my timing is just off such as my trade on LXU. I had a few small losses because I chased the stock instead of buying on a dip off it's highs. Right before the market close I did buy on the dip at 5.90 where I initially wanted to buy at. The next day it spiked 10% to 6.55, but I did not take profits as I thought it could go to the high 6's where it had resistance on the multiday chart. It came back down from 6.55 to 6.20 and then to 6.00 where I got out for a small gain. It did bounce right at my entry price at 5.90 and it has been in a steady uptrend ever since, closing Friday at 8.51. My thesis was right, allthough my timing in buying was off. I did not wanted to see the stock going under 6.00 so this is why I sold. Trying to protect my money before losing it. I am very pleased with what I did on that trade even though it is up 44% from where I bought. This just proves to me that my plan was right.

My trade on CANN was a big loss for me as I could not get executed when I bought too early. I noticed all the marihuana stocks starting to panic and I was looking to buy any bounce. I was analysing CANN and it had strong support at 4.00 on the multi day chart. However, I was not patient enough to actually see the stock bounce. Instead I was buying a falling knife. It did not show any signs of bounce or support at 4.00, but yet I was already in the trade from being to jumpy on it. Tried to cover my loss at 3.90, then 3.80 then 3.70 eventually getting out at 3.57 for a $100 loss. I was so frustrated then. Then I was watching it holding the 3.50 as support. I was thinking about buying it now once it would go to 3.60. But because of my earlier loss I decided not to. This was actually the place where I should have bought as it went from 3.60, straight to 3.90 and eventually to 4.20. This also tells me that my initial plan to buy was right, if I had just paid more attention to the price action!

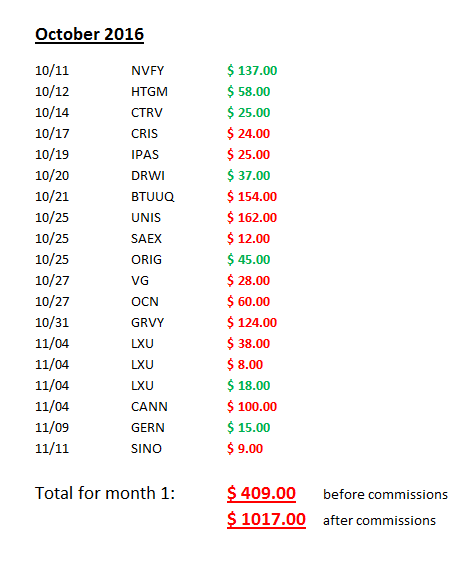

I am from the Netherlands and have just recieved approval to work in the United States. Right now I am trading with SureTrader since it's the only broker out there to trade penny stocks for non US citizens. However, when I move to the United States next month, I will be opening up an Etrade account. The reason is that SureTrader is just killing me on commissions. I've had a little more than $400 in trading losses and another extra $600 on commissions. Just cutting my losses quickly is still not a small loss with the amount of commissions I have to pay. An $8.00 loss with SureTrader is actually a $20.00 loss. When I traded blue chip stocks I only paid $5.00 for buying and selling, so a $8.00 loss would only be $13.00. Of course depending on your share size.

This month has been very educational to me and I am glad that I started to keep up a spreadsheet, building my own watchlist, finding my own trades, analysing my own trades and finding the problems on every trade. I am excited for next month and I can't wait to start trading in the US with another broker.

Here is my PL summary for every trade over the last 4 weeks:

That $8 lost would cost you $28

@Winstonofchange which one is your recommend?

@Winstonofchange I have not yet done sufficient enough research to actually open an account with Etrade or any other broker, just yet. First I'll need to move and once I've settled, I will find a different broker. Thanks for pointing it out though, they in fact do charge $10.00 per transaction!

@Khermus thanks you for your response. it is so useful for me for getting start to know all these information. I am looking forward to hear from you more in the future. thanks you.

Join now or log in to leave a comment