8/1 AM: Initially was watching CYTR for a potential short into a morning spike, as it's been up for two straight days and ran into multi month resistance at 1.00 a share. However, SLDC was panicking for it's second day, and I thought it would be a good idea to dip buy the morning panic. Bounced off of 0.05 from 0.13, so I bought 6K shares at 0.06. Then added another 10K at 0.07. However, then it came back down to break 0.05 and then seemed to hold 0.04 very strong. I put in another add for 9K shares at 0.042. Now my avarage is 0.0575 for 25K shares. Holding 0.04 very strong, and I think this stock can bounce huge. However, Tim has warned not to dip buy this stock right after I had my last 9k share order filled. Going to try and sell for breakeven or smaller loss. I think it can still bounce off of 0.04, as it's holding firm

Also holding a small 3600 share position in the E*Trade account from 0.041. Goal is to hold for a few days to the mid 0.10's or low 0.20's

CYTR and AXTI are doing exactly as I thought. AXTI is actually the best one.

10:45AM UPDATE: SDLC now at 0.058 with big 100K bidder and some hidding sized bidders in the low 0.05's

3:40PM UPDATE: SDLC now at 0.38 again. It broke the 0.04 level, and now bouncing off of 0.02 a share. Very speculative, and made a ton of mistakes here. Stil think this can see 0.10 a share by Friday. Holding and waiting for it. It did took out a 700K seller at 0.03. However, the insiders are still dumping their shares into any bounce. Since I have close to $300 in comissions to pay, I'd like to see if it can go to 0.09 or 0.10 a share by Friday.

4:01PM UPDATE: SDLC closed at 0.0326. I am currently down $622.00 in my SureTrader account and $38.00 in my E*Trade account. Good thing is that OTC stocks don't trade in pre-market or after hours, so I can't really do anything right now than to just wait until the market opens tomorrow at 9:30AM. Have to see what it does tomorrow, and see if it will bounce to the teens. Would really like to get out of this stock, as I've really screwed up here. Played it too big, trying to get my avarage down, and now I'm a big hole.

8/2AM: Stock could not break past 0.04 a share. Been watching it all day, but decided to stay patient and hold. It had held the 0.02 level, so I figured it probably won't crash down much more now.

8/4AM: It is finally able to break that key 0.04 resistance level, and held it nicely all day into the close. I had finally gotten some hope back for this stock, to be able to get close to that 0.05 a share level where I could sell for a small loss.

8/8AM: Instead of going higher on Monday, it actually panicked, and broke that 0.04 level again. Later in this afternoon it went even lower to test that key support level at 0.02 a share again. I am now down $850.00 before comissions. This was probably the worst day of watching the stock. This day, I was really stressed out, and felt like I was losing everything. I started to think that, maybe trading is just not for me. I have studied all these patterns, and worked so hard to become disciplined, and it has gotten me nowhere. At this point, I just said to myself: you can either sell or hold, but where is it gonna go? Worst case scenario is I blow my account over this, but it won't kill me, and it won't change my life right now. So I decided to hold, and it closed in the mid 0.03's again.

8/8PM: this night I was thinking about everything again. I was feeling down, and knew that I was stressed out ever since I had gotten into this trade, and deviaded from my plan, by not cutting losses quickly. All the studying I've been doing wasn't for nothing. I just needed to get my head back straight, and see how I was going to minimize my losses on this trade. It held that 0.02 a share level again, so that told me it was a good support level to play off of. I wasn't buying anything more, I could only just wait for it to break that channel above 0.05 a share.

8/9AM: I am watching the stock, and it has very low volume, and doesn't really move. I decide to search the ticker symbol on Twitter, and see that there are a lot of people talking about it over the last 7 days. Around 11:30, volume started to kick in. It ended up breaking 0.05 a share, and got as close as about 0.001 of a penny to my average buying price at 0.0575. I was trying to get executed, but couldn't get any fills, as I was trying to sell when the stock was turning. Like Tim Grittani explains, it's hard to get a sell order executed on OTC's when they are turning around.

Anyway, it closed in the high 0.04's, and I was confident that tomorrow, this stock could retest that HOD from today again. It had traded over 9M shares, which was almost as much as the first big crash day. I put out more tweets in all my different accounts, hoping for this stock to go back up the next day. A lot of people were talking about it on Twitter, so I felt confident that it could go up.

8/10AM: So, today it came down a little bit at the open to retest yesterday's support at 0.04. A lot of 100K+ buyers were right around that level trying to get executed. I was at my girlfriend's place this morning, and up until noon, the stock did not do much. It was hanging in between 0.039 and 0.045 (yesterday's closing price). I figured if it could go r/g it could test yesterday's HOD again.

I was heading back home from my girlfriend's, and about 30 minutes into the drive, I notice the stock going r/g. It tested that key 0.05 level it tried last Friday. I knew I had to pull over. I stopped at the nearest gas station, and parked my car. I had my laptop with me, so I opened up my E*Trade account, and SureTrader account to start putting sell orders in. The stock started breaking past 0.05, tested yesterday's HOD and then tested 0.06. I had a sell order at 0.0599. It quickly broke that 0.06 level and went to 0.062 before coming back down fairly quickly. I got all my shares sold, and SureTrader gave me a great execution at 0.061. I ended up making a small $87.00 profit, but after comissions I will still be down about $150 on this trade, which is way better than the close to $1100 loss I could have had last week!

I still had my 3600 shares in my small E*Trade account. After I sold my big position, I put in a sell order at 0.0615. I got all executed at 0.0618 for a small $65.00 profit.

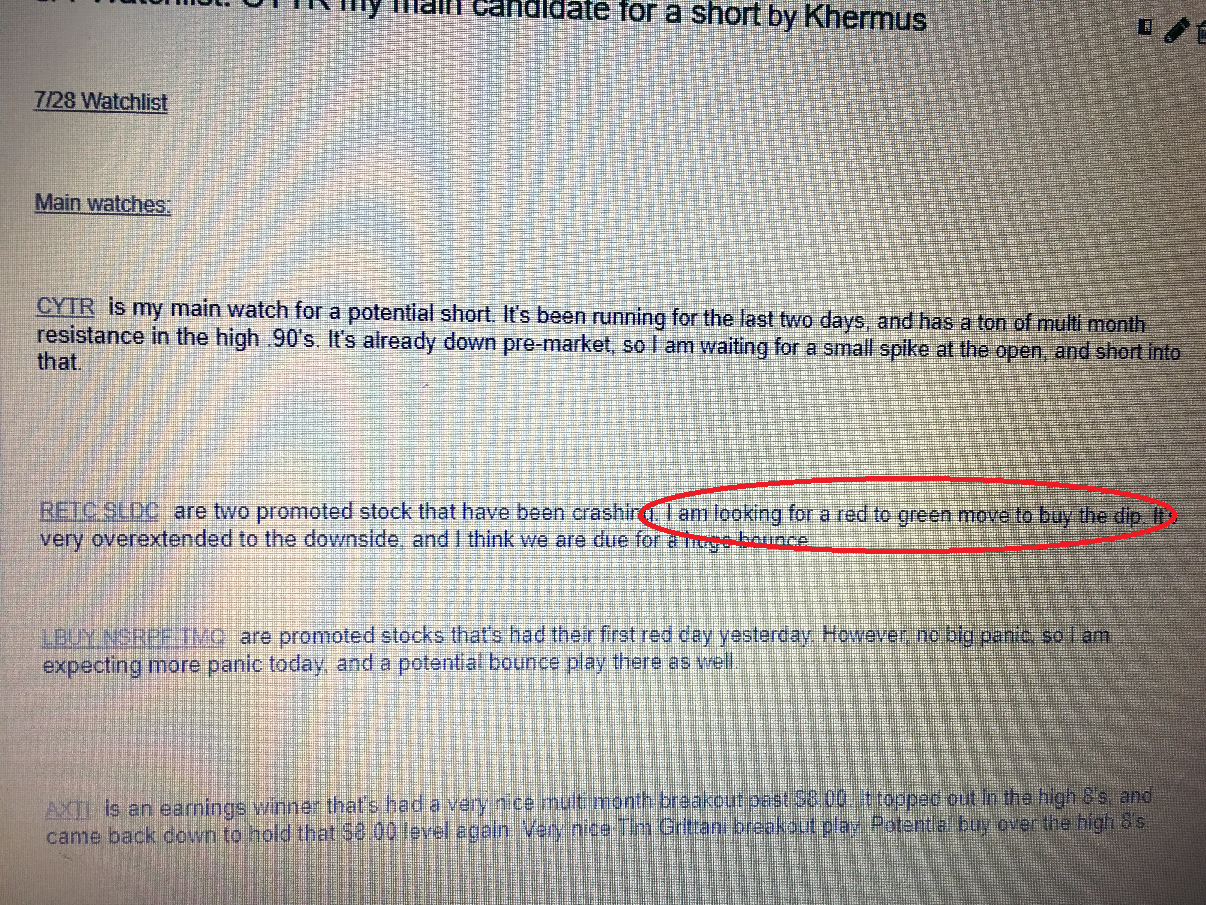

I was very relieved, and immediately said out loud (yes in my car out loud lol) "I am never going to go through this stubborness again". These 9 days have been the longest 9 days of my life!! I ignored so many things, I ignored Rule #1, I ignored Tim's warnings, I ignored the chart pattern, I ignored the risks of buying these risky promoted stocks while they are coming down. I even ignored my own watchlist commentary. I specifically said in my watchlist from 8/1: " I am looking for a red to green move to buy the dip". What I ended up doing was trying to catch a falling knife. I was more comfortable with shorting CYTR that day, since it fit Tim Grittani's pattern to a T, but I thought I could make a killing trade on SLDC, since I could load up on a ton of shares and make a quick $1000. Those trades will come, when you get consistent. But I was forcing it.

I learned a lot on this trade, and I gained a ton of experience here. What I learned the most is respecting the rules Tim Sykes, Tim Grittani, Mark Crook, Micheal Goode and Tim Bohen teaches. It is very easy to ignore them, but until you experience the stress over it, I think it's hard to respect them.

You seriously created multiple Twitter accounts and pump the stock?

Join now or log in to leave a comment