Good day everyone!

I've just decided to post my watchlist online as a way to increase my dedication. My name is Josmer, I'm 25 years old, currently working full time on trading, initiated with a 6k account on IB, and also working on my graduate theses in Finance. I've been dealing with fear of losing since placing my first order (9-10 months ago) and just recently upgraded my cash account to margin since I believe I have "enough" experience to make bigger trades.

This is a LONG focused watchlist, I haven't started shorting just yet. Stocks on watch will be placed as Tier 1 and Tier 2, being the first one my main watch on the day and Tier 2 the "just in case" kinda plays

Tier 1

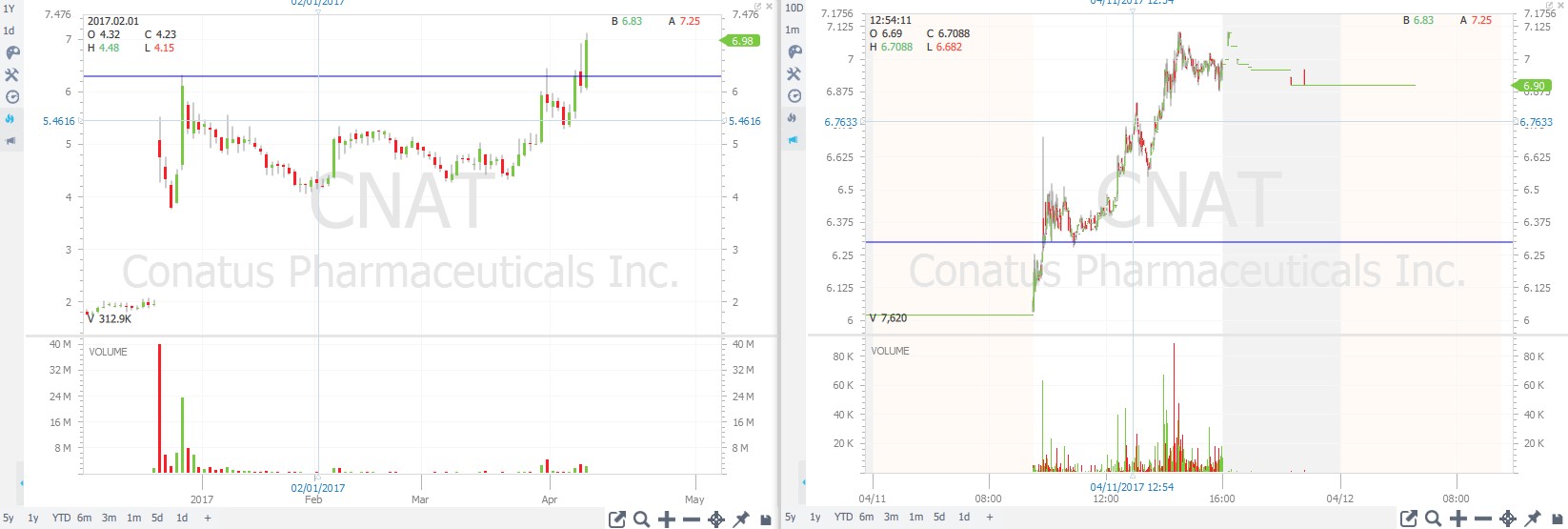

CNAT - Up 14.43%, it barely broke out above 6.3 a couple of days ago, then consolidated yesterday made a new 52w high. It spiked at Market Open (MO) and dipped perfectly to key support 6.3 (which would have been the perfect entry) before uptrending all day long. Finished close to its highs so we might have another breakout, though it might need some consolidation first. Only a dip buy for me; since it doesn't seem to get much volume @MO, i'm expecting a silent drop to 6.9-6.8 and then a bounce to either yesterday's highs or a new high. 20 to 30c upside based on that entry. Speculative play all the way.

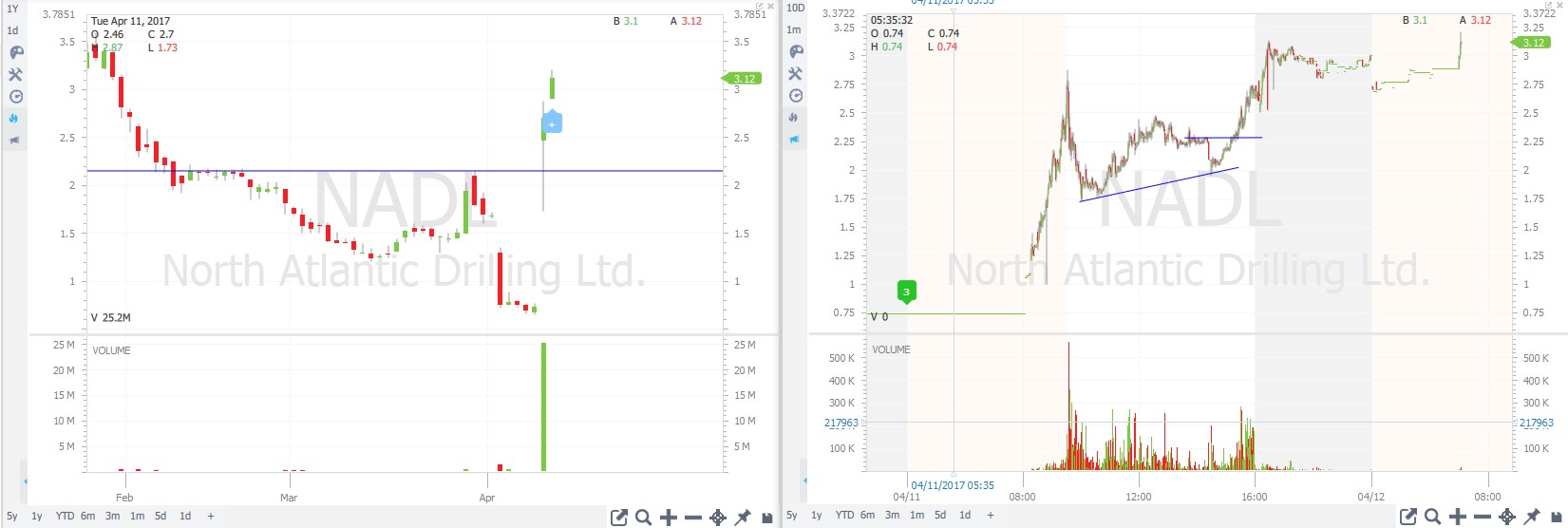

NADL - Up 267.35% - Oil Stock - Had really good contract news Premarket (PM) - I'm guessing people took their profits at the bell and so it went down gradually, found a bottom @1.72 - Best play set itself up in the evening after some panic selling and a halt (though it's really risky when that happens) stock held support @2 and since it was a higher low on the intraday chart it would have been a good entry if you could hold through the choppiness. Also 2.2 (resistance on year chart) and 2.3 (intraday before it panicked) would have made nice entries imo. I didn't play it as it's not a sector I tipically watch, I was really scared of it since it was up 200%+ and there were several warnings from Mr Goode in chat. Continued uptrending AH. Gapping up 7% today, 2.7-2.8 might be support and potential buy though its rather risky given how much its up. I'm at least expecting it to retest AH or PM highs and then come down for consolidation. Short Squeeze is also a big possibility. I'll most likely stay away from it though it's a main watch.

Tier 2

FNMA/FMCC - Brought to attention by "Apr 11, 3:24 PM MichaelGoode Fannie Mae and Freddie (+7%) both seeing strength in recent trade following report that Treasury might back away from support of FHFA structure" - Overnight was a possibility though this may have some upside today as well.

STAF - Up 21.8% yesterday, has now had two big green days and is sitting close to breaking out - Slow mover - No news so speculation at its best, this might have some more upside but I'm not thrilled about it just keeping it close to the eye since it's a technical breakout in the making.

All of these are 15-25m float stocks so don't expect anything quickly. That's it for today. I will keep posting my watchlists around this hour and may include in the future some premarket gainers. Good luck to all and good day!

Join now or log in to leave a comment