Good day!

Yesterday I talked a bit about myself and today I want to share some of the criteria I use to select my Tier 1 and Tier 2 Stocks. I trade from a outdated laptop so I some restrictions even with software so I'm really choosy and put most of my attention on 2-3 stocks only.

Tier 1: First of all I need them to be in play, so volatility (upwards intraday chart and 30%+ gains) and volume (more than 1m+ though lately even that seems like too little) are big factors. Float is my second big requirement (up to 40m usually) since the larger the float, the slower it's going to move, so even when stocks like $PLUG and $NAK are having 30-40c upside thruoghout the day, I basically ignore them completely since they drain my attention from other big potential gainers. Significant news and a good response are also key but since we've had so many stocks running without them basically I am not as "harsh" with these ones.

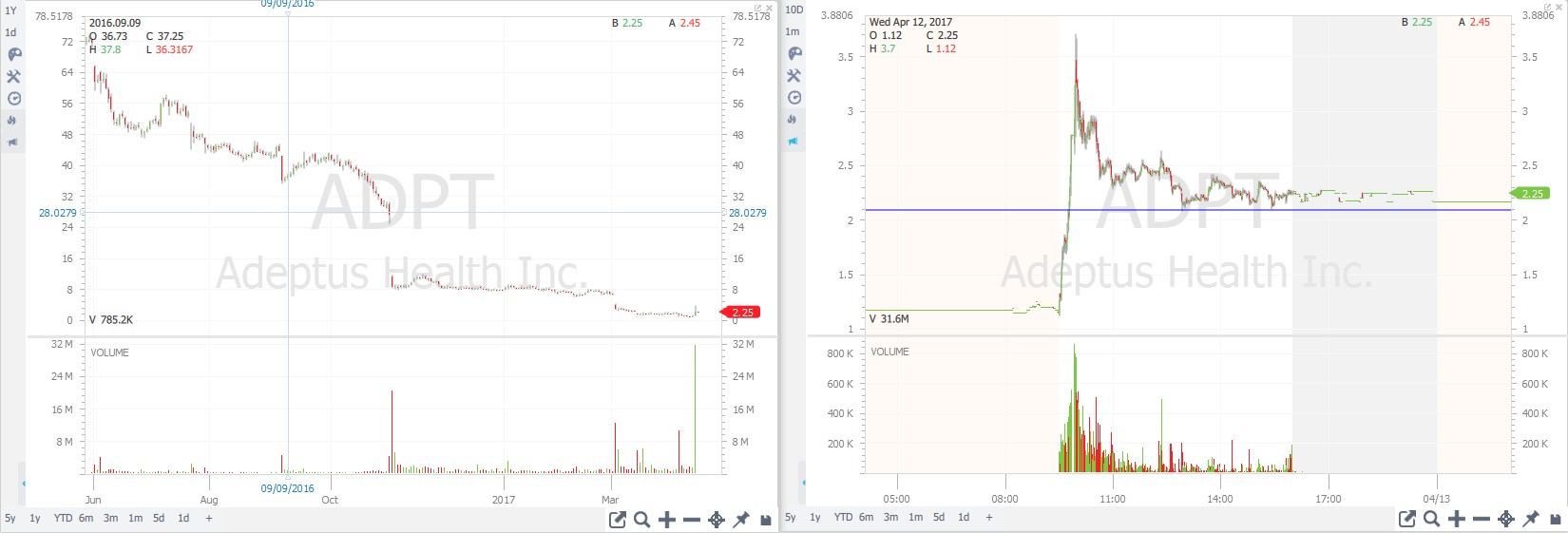

ADPT - Up 108.33% - Had a big spike @MO on news of a big hedge fund investing in it. Lost half of its gains through the day but held support @2.1 quite well so we might have a bit of a bounce and more consolidation today. Chart is really bad and it is up 100% . Also no history of spiking big and it doesn't hold well to its gains so I would be cautious with this one.

OCRX - Up big AH apparently on preclinical news, not so significant but float is right and its up big. Watching @MO for a retest of highs though I'm not expecting much of it afterwards this market shows us that even without a good catalyst this thing can run for a while.

Premarket we have $EYES gapping up on good news, though its chart is not ideal, volume premarket is rather good so potential play and main watch.

Tier 2: Anything that has met the criteria for Tier 1 but isn't as volatile. I usually have this one up looking for continuation or potential plays.

NADL - Holding 2.5 So far, not a reliable support. We could have a bounce on this one, since news was quite big. It looks like it still has some more downside before it though so it's a potential dip buy. Not excited about it since volume isn't the same as before though.

CNAT - This one could have been a great hold, since it gapped up, it has kept its gains pretty well and broke out some days ago. Though it didn't bounce yesterday as i was expecting, it still managed to bounce after breaking down close to EOD and it's now setting up really close to yesterday highs so we might have a new leg soon. Bad thing about this one, It's moving on low volume so risk is higher.

That's all for now, good luck on your trades and happy holidays to everyone!

Join now or log in to leave a comment