'Four out of five stocks follow the market' – Tim Sykes

'A man may beat a stock or a group at a certain time, but no man living can beat the stock market' – Jesse Livermore

I’m four months into my ‘trading career’ and one of the most fascinating experiences I’ve encountered is the art in which I (or we as humans collectively), learn.

I obsessively watched DVDs from Tim Sykes then rushed out into the stock market and did everything he told me not to – then – learnt from my losses.

So are Tim’s teachings absolutely irrelevant – absolutely not – the initial loss reinforces Tim’s teachings and you never make the same mistake again. Well, maybe you do, once , but never twice.

In my opinion, the best lesson Tim has repetitively taught is: ‘Four out of five stocks follow the market’.

It isn’t even a lesson – it’s a statement – but one you should always abide by. Similarly, Jesse Livermore, in his book: ‘Reminiscence of a stock operator’ reinforces this as he explains how he would avidly monitor the market to decide when to go long or short on a stock throughout his lifetime.

Nevertheless, we always learn our lessons a little, well, late. I’m no exception. But, I hope this post – as cliché as it sounds – helps one less person lose due to my writings.

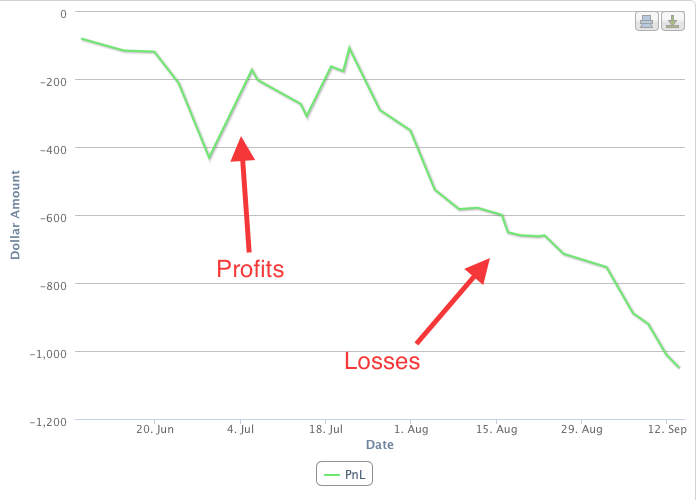

How am I certain? Look how my profit/loss chart resembles the chart of the Nasdaq. A little too close to be a coincidence, don’t you think?

Let me add my own quote: “When the market makes money, you can make money too. But when the market is losing money, it’s time to consider becoming a bear.”

This is just one of many variables to being profitable. My intention is not to detract importance from another variable, but to simply validate its importance.

And to close, these lessons are shown throughout time, the market has been through several boom and bust periods: ‘The Wall Street Crash (1929)’; ‘Black Monday (1987)’; ‘The dotcom bubble (1990s)’.

Each period saw thousands win and lose millions. The simple rule many didn’t follow - not following the market.

And as Jesse says: “…no man living can beat the stock market.

I have no idea what you're trying to say here, but we removed link to outside website

I'll explain a little more succinctly for you, Tim. You made a statement, but it didn't sink in to Jonk87's brain. After some real-world experience, it sank in. The title may be more like "The best lesson I finally learned from Tim Sykes, but that doesn't sound near as interesting, does it?

It doesn't sound as interesting! But, fair point I don't want to give people the wrong impression when using your name Tim so I've amended the article and added the full post above. Sorry - I did not know you couldn't use links in the way I did here.

Join now or log in to leave a comment