Living in Dubai there's not many Newcastle, UK girls here - so to have one come for a 'DVD night - Netflix and chill' on the weekend is an amazing opportunity. Read the full blog to find out why I cancelled the evening date.

Nobody likes to lose. And, frankly, coming off my biggest losing month to date, that includes me. In reality, I don't feel too discouraged - it doesn't feel too painful. It's part of the journey and providing I learn from the losses it's money well spent that I was ultimately going to lose at some point, anyway.

What does frankly, irritate me, is that people love to hate on penny stocks and some inbread degenerates like to hate on mentors who teach stocks, such as Tim. I don't want to give the haters more ammunition to hate because I know from personal experience the challenge is awesome and I've learnt invaluable lessons from it. I hate the fact that my stats don't accurately reflect the quality of the education.

But they will, I've only been in the challenge three months and I'm learning quick.

After breaking even in November, I thought I was on my way to profitability. I'm not there yet. I wanted to review my three biggest losers so hopefully you - and I - can learn from them.

The trading journey is a tough one full of highs and lows. And, coupled with the fact that you have to balance it with a full-time job and other responsibilities make it tougher. Guys, I feel your situation if this is your predicament. Nobody likes to take a loss and go to their day-job the next day. It seriously fucking sucks.

People think I'm crazy when I turn down social occasions. But I'm so heavily invested in this. I couldn't walk away from it living the rest of my life thinking, what if?

And in reality, the people who are crazy enough to think they can change the world are the ones who often do. That's a Steve Jobs quote, by the way.

I hope you can learn from my three biggest losers. I just want to make a bad situation better. And if I can help others through my errors - then this is a good thing. The charts are using Stocks To Trade, the software is awesome and scans have helped me pick the winners of the day - if only my timing was a little better.

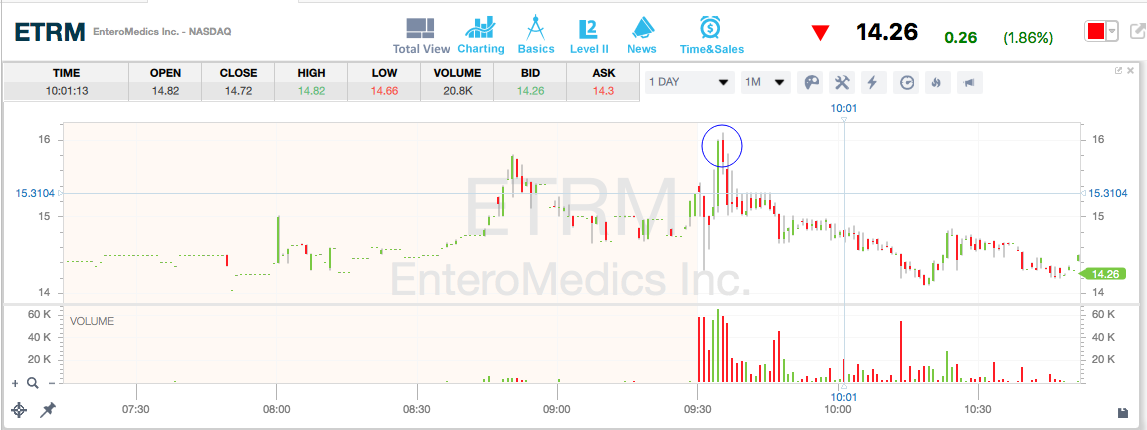

Loss 1: $ETRM

I'm pretty sure this is my biggest loss to date. It's a Penny Stocking framework number 5 pattern. I wasn't buying off solid support but that was not my main concern. More $ETRM is a very choppy stock and I never ever do well on stocks above $7 dollars - for whatever reason they just never work out.

The more important lesson is to wait for it to convincingly breakout above its pre-market highs. I bought literally into a wall of sellers just about resistance. It slammed back down so fast I took a significant loss. The 'Big picture' set up is still there and it should bounce when it's 40% off its highs. BUT my entry was poor as I should have waited for a more convincing pre-market breakout.

Loss 2: $MYOS

This stock was around 200% up which isn't surprising with 20 million plus shares on a 400k float. I jumped in on the breakout because it had spent a few hours consolidating. Its daily chart is also a multi-month possibly multi-year breakout. I was on the right track as it broke from the 4s to the 7s.

The error, the breakout failed where the ascending triangle failed and the stock is so volatile I could only get out for a large loss before it actually pulled back and did break out.

My timing was obviously off here and I'd had a few glasses of wine to make things worse. A breakout at 1:30pm isn't the ideal time to buy but volume wasn't really an issue here. Again, I think waiting for the convincing breakout and holding on the trigger was the difference between a 150 dollar loss and a 450 dollar win. In general i'll avoid stocks with choppy charts in the future - I can't risk these big swings in price action.

Loss 3: $ESEA

I didn't know this at the time but $ESEA, despite having good news, wasn't an amazing trade if we all realise news is only one indicator. In truth, I want to become a short bias trader so I don't have to rely on news as much but rather wait for a stock to become over-extended and short it.

$ESEA had immediate daily resistance above it so it's no surprise people were selling into the spike. Had I have known what I know now I wouldn't have played it.

So to close. The reason for my losses are being a little trigger happy and jumping into a stock before it has really proven itself. I unfortunately learnt this the hard way through hard losses. But the beauty within the losses is I've learnt something key.

If we can all be self-analytical like this then there is no reason for anyone ever to be dishearten and quit trading. I enjoy trading for the self-reflection and the process of learning something new. Not to get rich. If you're trying to get rich you're in it for the wrong reasons in my opinion.

I'm proud to be able to understand and analyse my mistakes with conviction. Without Tim's teachings I would not be even close to being able to share this knowledge. I owe the guy a lot and will repay him one day.

And why did I cancel the girl? Whilst instant gratification is fun, I have some video lessons to watch and more to watch in the morning.

How could I focus with a lady in my bed ;-)

Wait for me, I am coming...

@cmasson I agree yesterday was the better bounce play in the morning as it was uptrending gradually pre-mkt and you could've bought the dip at the open. Today it lost momentum so couldn't spike as much and is a perfect example of the bouncing ball example that Tim always uses.

Hi Stephen... my reviews of these trades were dm'd to you on your twitter account.

@krs1 :-)

Join now or log in to leave a comment