It took roughly four months of being in the Tim Sykes challenge and around another six months learning from other Tim related services and DVDs but after ten months I feel I've cracked it!

You may argue that it's too early to say but I will argue: 'when it's something real, you just know it inside'.

And trust me I've had no lucky wins, this has been a pure grind.

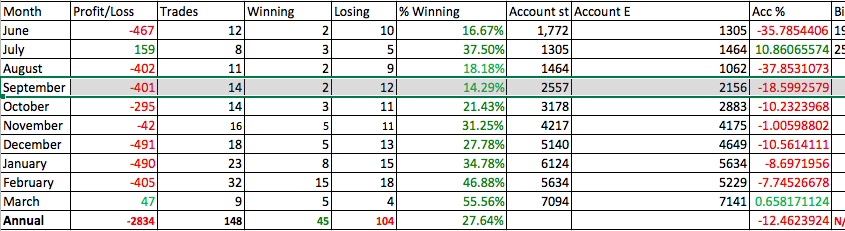

We're in the first third of March and I'm positive I'll end at least breakeven give or take a swing of $50 dollars. I am arguing this point with conviction because I just know what set ups work for me and I know how to trade them.

My battle is not one of technical or fundamental analysis now but much more of psychology and discipline.

I now have the ability to see the warning signs of a market change in direction and I can get out before they happen.

When you see the light, trading is actually incredibly simplistic, but before you do, it's considerably more complicated.

For those stuck endlessly losing trades, here are my five top tips for getting your winning percentage in the 50s.

1.) Watch video lessons and webinars until your eyes bleed

Yes, sometimes it's boring. Yes, sometimes your sitting there thinking 'Tim I already know this stop repeating things'. Yes it can feel like you just watched a 20 minute lesson and you can't even remember any of the tickers talked about.

But trust me, it sinks in somewhere and sooner, rather than later, you'll start to develop a weird sixth sense about the market and you'll think: "How do I just get this? Oh, it must be all those hours of video lessons"

2.) Analyse every trade you make.

I make videos to analyse and recap on my trades. If you follow my Instagram: @StephenJonk87 you'll see regular snaps of an insane collection of printed out charts on my walls. It's necessary for your learning and you can look over lots of information at once.

3.) Find your set up

Find a daily and intra-day set up that appeals to you and stick to it, master it, only trade if that set up comes up if need be. But refine that set up until you can predict what's going to happen before it happens.

4.) Accept losses

It's okay to be wrong. Taking small losses is a good thing. It's healthy, like the occasional salad. When you enter a trade you're playing the odds, and you should never expect to be right all of the time. When I get into a trade I'm immediately preparing my self to take the loss - and I'm more often than not, pleasantly surprised when it works out.

5.) Accept uncertainty

I have an inkling most traders don't lose because they love to self-sabotage themselves, although I'm sure some do too. But for the vast majority, it's that they believe too much in their set up: they, 'must be right'.

It has to be accepted that as a trader we don't know all of the variables, we can't predict how many people are on the sidelines waiting to jump in a trade. We don't know if there's one huge seller or institution about to drop the stock.

So expect the unexpected, always.

I'm writing this to you guys whilst I'm still on the fence of a losing trader. Because I know now I'm coming into profitability now and I want you to believe it's possible too.

Hasta Luego - see you on the green side.

We're all rooting for you man! Please don't every give up! You inspire us all!!!

@Deep ha cheers - getting there :-)

@AngelofPeace that's awesome to hear thanks so much - working hard to break through - closer than ever :-) Really appreciate your feedback

@Jonk87 You bet brother!

Join now or log in to leave a comment