January, 2018 Review

Been apart of Tim's challenge for a little over a year now. Ive worked so hard to even get the slightest results. I've tried multiple set ups but I never really got the hang of anything (big the picture idea). I've recently been focusing on OTC/Nasdaq breakouts since then ive been profitable. I still have so much to adjust to my trading but this is where it all begins this is my first month where I will review my flaws with my strengths. Sorry for any grammer problems I'm not even trying to be perfect got a lot more important things to worry about at the moment. So to sum this is the reason for this post is to show my progress what I did right what I can improve on. Also in this you will notice that I tested a few strategies this month.. Yet I still ended with a 66% winning avg.

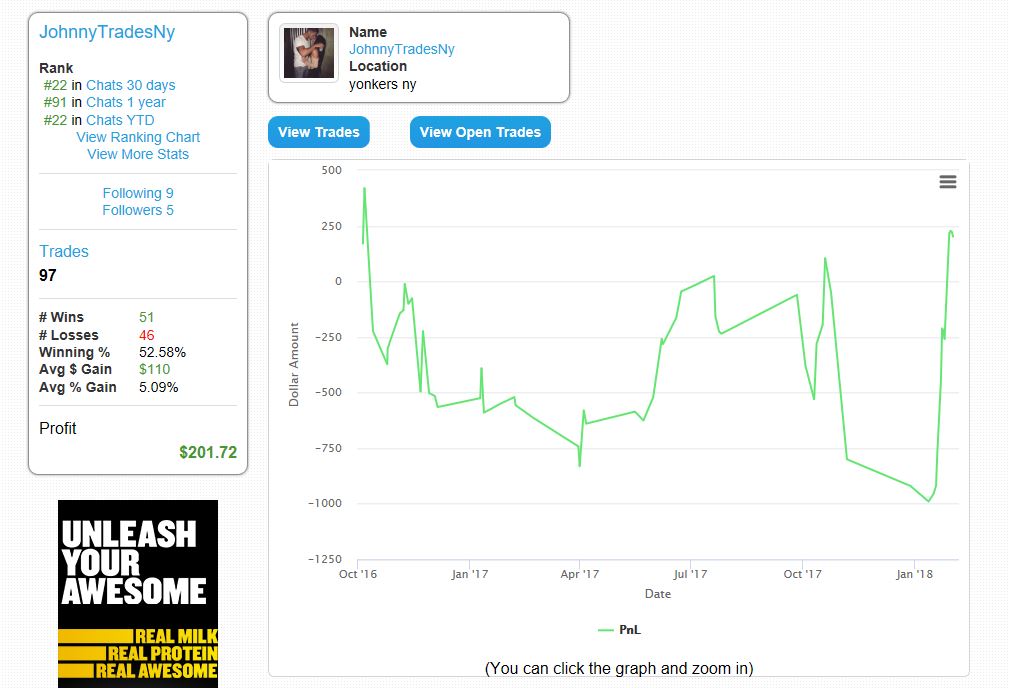

So to explain the progress chart above. Its extremely choppy gross if you ask me. But it has a lot of history behind it Ive been working countless hours all dvds, books etc. When I first started you can even look at my twitter I would stay up all night study 10+ hours per day then go to work heavy construction in NYC. All around I cant even tell you how hard I worked just for this green month. Considering its been small size I'm very happy and even more motivated to work my ass off. Starting off I lost $1000. I have to say it wasn't because I didn't know strategies ( I knew strategies but to many) No niche. But also because my weakness was me. I had no real mental. What I'm trying to say is I played for money but even to this day I play money cause its what we all want hence why we trade. But now I focus on big picture the "Now" moment. I don't ever go into a trade with espectation because this game is all about probablility an edge that's it. Its all odds I find when I have the mindset I'm gonna win I loose because I don't cut loses. So now I go in with "ANYTHING CAN HAPPEN" mindset. 1. Cut loses 2. Always have a plan prior to entering any trade. 3. Take profits. The strategy isn't hard in this game I think the hardest part is controlling yourself. Ive been reading a lot of books to help me stay disciplined in this game. I have to say this has been the most helpful thing ever. The one thing from the start to always do I self observation. How do you trade? Are you patient? Do you force something? Not cut loses? This is all the stuff I asked myself and I found the answer. I had a lot of problems but the key to fixing the real issue is to isolate it. That's what ive been doing and still am. Nobody is perfect but you can discipline yourself.

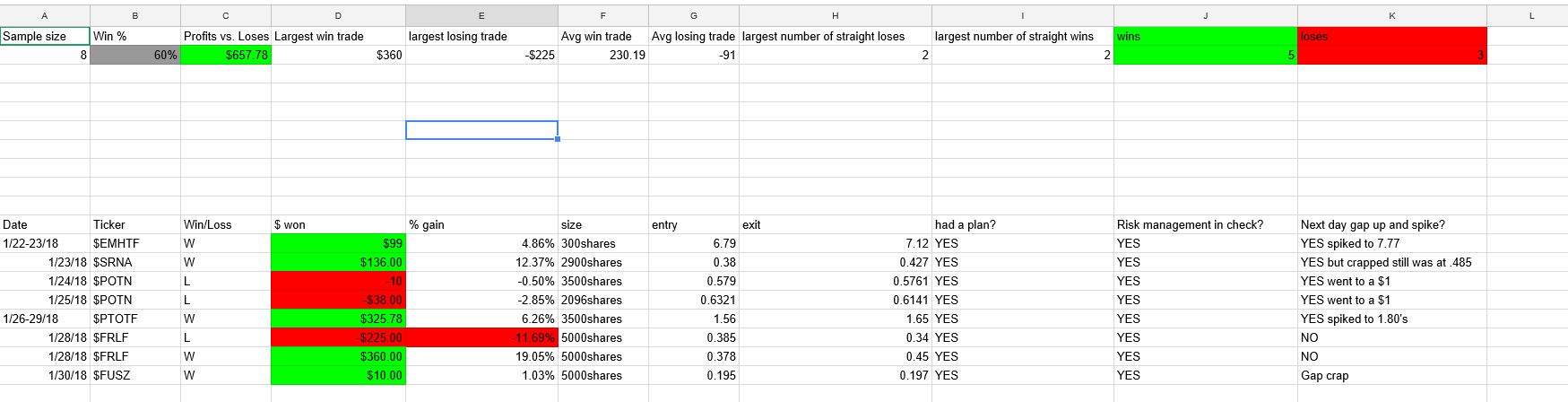

Now lets look above. I have 12 winning trades. 6 losers. Small loses big wins. My biggest loss was $225.00 because I wanted to up my position sizes so this kinda messed up my progress cause it wasn't my typical size. In the end even after the "Bigger Loss" I still came out $1,100.00 richer. One step forward if you ask me. But I wont get cocky.

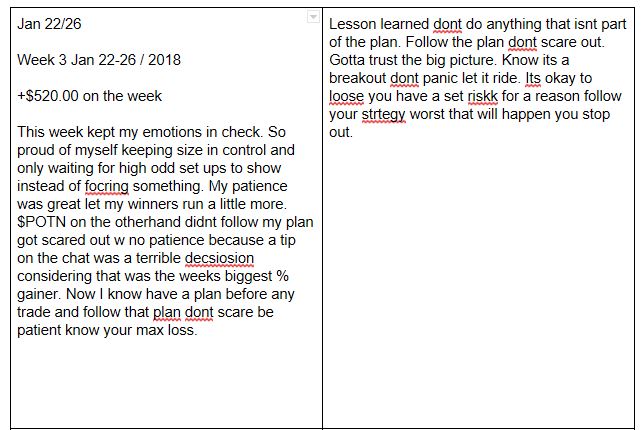

So lets look above now. The first week in Jan I still didn't find my Sweet spot so that $70 loss was me hoping for something to work. So this month been more of a testing month of my new strategy that I will only play until I'm a master at it. I came out with a green month very happy about this but I believe ill do so much better in Feb. Something about just alittle confidence boost is what I really needed. Working crazy hours studying but no real results is so stressful. Ive wanted to quit multiple times because when id review my week I would realize I did the same shit I did from the previous week over and over. So I recommend everybody to track each trade.

Example.

| Ticker | Entry | Exit | Size | Plan? | Risk management? | Follow plan? | Emotion? | Lesson learned? |

Now after this at the end of each week make sure to do a full week review and point out what needs to be fixed. This is the only way to be a real consistent trader do the extra work that the 90% doesn't. How bad do you really want it?

So above is my weekly Friday emotion review. As you can see a lot of spelling errors not because I'm dumb but because in this I type very quick what's on my mind about how I felt in every trade this will be a MAJOR help. Just type away let it all out then review and keep it in mind for the following Monday. This will make your mental game a lot stronger cause it will remind you about the past errors and what not to do.

Above is one of the main strategy's Ive been playing the last 3 weeks. OTC breakouts TBH the winning % should be better but I still have some stuff I got to recognize and fix that ive noticed that some losing trades that ended up being winners a few hours later.

Now lets review (btw remember I only play OTC/NASDAQ daily beakouts) for the future cause I will make a point soon)

Lets review $FRLF s=this ticker scared me out. I did follow my plan but I'm stuck because the result was upsetting. I still cant decide if following the plan and selling on that weakness is good considering the stock can just free fall with no other better exit point or wait for the bounce to get out. I do believe just cutting loses was better because if I didn't cut loses and let it grind down n me my confidence could of been hurt and that's one thing you don't wanna destroy. But my framework was great how I handled this. Now lets look at the chart.

.35 yes that's the Multi day breakout. I would buy right into strength on that thinking it should go up or maybe even pull back a little but I like the idea of knowing I'm in the stock. Just to note a breakout doesn't always hold its breakout its very rare so have your risk on previous day support not the breakout point. So know that you know that's how I set my risk you will see how I got faked out on this in the following chart.

So here I missed the initial breakout who cares always another opportunity just got to be patient. The stock dipped the first time to that breakout level and confidently held. (bullish) Now it spiked up back to HOD on the following quick dip I entered with my risk on where the first dip from the morning spike held .35. That was my risk as I considered that to be the major support line. Also buy weakness on dips not strength (Only buy strength at initial breakout level my opinion) So now I'm in a 5000 share position. I'm very comfortable here knowing my risk and I don't mind loosing the 225 because I would never get into a trade if I first don't accept what I put on the line. I got faked out. But it wasn't because I was scared but the key support broke and I didn't wanna risk a big loss for any single play. I followed the plan. Now I see it jump back above the breakout consolidate. Remember what I said its rare all breakouts hold the initial big picture breakout. So when I got in again its because I felt it striked the weak hands out like me then bounced consolidated above breakout(bullish) So I remember my knowledge this isn't uncommon so I got back in towards end of day. The stock had a nice end of day breakout for a bigger win then my loss of $360.00. Now the overall issue here is how do I avoid that from happening? You don't it happens but its better to get out then to risk an upset. This wont happen every time.

Now lets review another trade here $EMHTF

Bought this multiday OTC breakout had a great 1 year chart where it spiked in the morning for a breakout of $6.64 the morning spike was to quick then consolidated holding nicely bought in the afternoon once it broke the morning hod 6.80 anticipation for a strong close gap up the next morning. This is a weed play so we all know how hot these stocks been. Came out to be a nice play only thing that concerned me was how many days on the daily chart where straight up green to the breakout. Overall came out w a win. Best choice was to wait for afternoon breakout considering how fast the morning breakout went confirmed consolidation was best entry that high break.

Emotions: Well for one of my first OTC trade felt very comfortable considering I had the plan, I knew why I was in the trade. It wasn't a forced trade it had a big picture set up. I had my goal, risk, entry, size. Risk management was in check. All factors went together. Smaller size then I wanted but great plan, strategy, discipline , patience. Never let any drops scare me out considering I have a set risk & I am not gonna sell unless that risk gets taken out. Very comfortable since I had a big picture plan!

I bought this after the breakout the entire day it consolidated above that 6.64 lvl was very bullish so I got in thinking HOD break for morning gap up considering OTC run for multiple day

OTC multi day breakout $SRNA

Bought this multiday OTC breakout with a great plan had great patience seen the set up and striked. I got in at .38 got out at .42 for a 12% move as you can see I can have a lot more patience for these set ups then I usually do. A goal is to be more patient. No breakout goes straight up. I liked how the breakout played out which caught my eye. Broke out dipped below breakout dipped above consolidated. My plan was simple buy on dips of consolidation with a risk on the previous tip with a goal of HOD breakout. In fact that is what I did and it played out in my favor.

$POTN this stock was my biggest upset yet.. But a lesson.

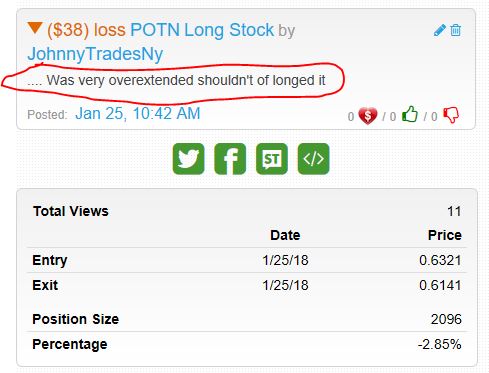

So this stock has treated me like shit.. Just kidding I wasn't on my game for this play I anticipated a move which ill never do again especially 4c away from the breakout. I was a day early as you'll see next. I got in at HOD break in the afternoon thinking big picture it will run through the 52week high. In fact it did not. .57 entry .576 exit..... Lesson don't anticipate. Now wait to you see this.

$POTN the following day...

Do you see my comment? What the hell was I saying? The fact is a chat room comment scared me out. I took an opinion of someone else and believed it. Never again will listen to a chat room. I didn't follow my plan. The big picture was perfect who cares take a loss of your risk but don't scare out ever.... .58 was my risk not .61 (So example of follow your plan cause this thing went to .90c the following day

$PTOTF

Bought this OTC breakout past 1.54 got in at 1.56 with 3500 shares. Had a plan for this set up had my Entry, Size to risk, stop loss and goal written down. Liked the set up but my patience could of been alitle better considering i got out monday 1.65 now its 1.89. Still overall a great trade took meat of the move defffinently can start being alittle bit more patient on the BIG picture breakout considering almost every play i get into goes alot more then i anticipate should trust the big picture breakout to run more. The second day i could of got in when it spiked in the morning pulled back held then consolidated above previous day high for afternoon ramp.

Lesson:

(Should let my winners run more not taking profits so quick believe in the big picture set up breakouts are choppy but run farther than you think.

Sometimes if price action is holding you can get in on the second day of the breakout but never day 3

Lessons for Feb

I think the main lesson is Stick with daily chart breakouts I'm not gonna review all my trades because the rest are small loses which where not part of who I am as a trader. I know not to play random plays. Feb I will only play BREAKOUTS. Be more selective. Trade less but when I do see my set up go big. I will also be increasing my size. Also to consider I should never anticipate a breakout it has less odds of a play, Plan? Yes now I will be following every plan ill accept the risk I put on and wont get scared out anymore. I still have a lot to work on but I'm taking it one step at a time to perfect my craft.

Great review! I look forward to reading this again and tying it in with the videos from our gurus! Thanks for sharing!

thanks for sharing! this is great

Do you base a lot of your trading psychology on trading in the zone?? it sounds like you have adopted some of marks techniques

Just listened. You have so many good things going on and the things you need to improve on, you point it out in the video. One thing I heard DUX say is if you have too much emotion, you wont make any $. I recommend taking a longer term view, make solid trades and good things will come.

Join now or log in to leave a comment