(Note. This recap is for me to process how I traded today, but I'm posting here in case anyone else finds it useful.)

To preface today's recap, around 4-weeks ago I re-discovered the type of technical analysis (TA) which I used early on in my trading journey, allowing me to delineate more precise entry zones based on inflections on the chart. See FRSX example below.

Throughout 2019, I made OK returns, but my losses were definitely larger than I was happy with, and I now attribute this to a lack of precision with my trades.

See the chart of FRSX on December 22nd as an example — it's not a HOD breakout, neither is it a vwap reclaim— but this trade offered a 10-1 risk/reward ratio. The price range narrowed over several hours, while holding within striking distance of its highs. Once the symmetric triangle pattern was complete, it pushed through the upper resistance line and the stock surged $1/share by EOD.

FRSX is just a single example of the symmetric / descending trendline pattern — I have dozens, if not hundreds of examples in the last few weeks.

CBAT was the EV stock I had planned on buying if the $7.35 level cleared late morning, thinking we'd see a push near to $8 — I went long on the break of the intraday trendline, but my buy was premature without any volume spike, and I exited for a 10c loss.

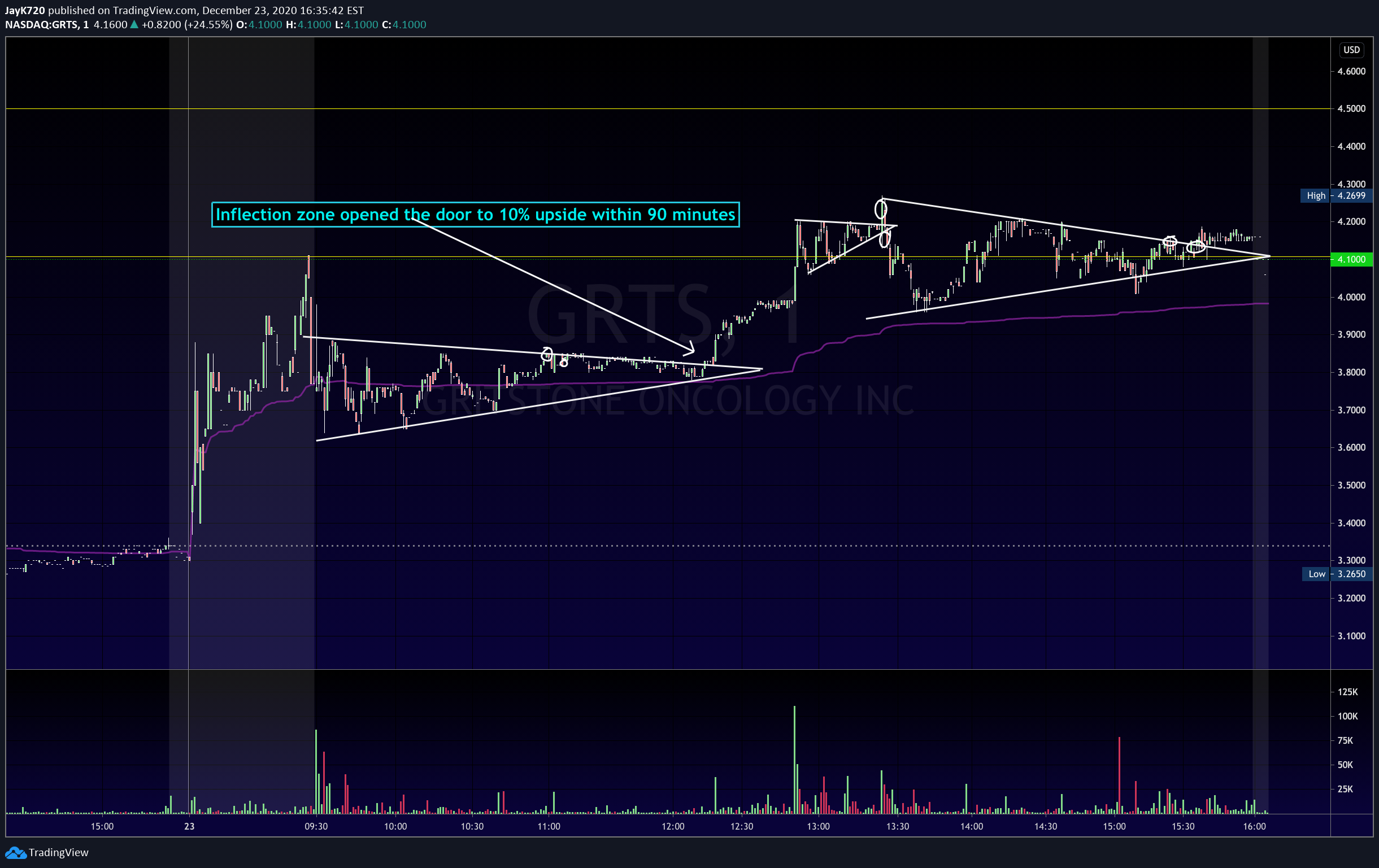

GRTS was my top potential long by mid morning — I loved the $100m+ private placement news / cancer-related setup / sub-30M float / hold over multi-month resistance at $3.80.

I went long prematurely at 11AM, without waiting for the 'focus point' to come into play, and stopped out for a 2c loss after realising my mistake. In summary, I made two errors:

1— Buying while the price range was still wide / non-focused (12:15 was the correct time to buy!)

2— Selling anxiously without the stock cracking the lower trendline.

The idea worked, but my entries didn't. See chart below:

Stupidly, my biggest loss on the name was trying to play the 'ascending triangle' at 13:00; a TA pattern I've always hated!

Heading into 2021, I'm going to continue to focus on refining my entries and timing for great risk/reward.

As Tim has mentioned once or twice: trading is a marathon, not a sprint.

Join now or log in to leave a comment