Monday, May 8, 2017

Monday, May 8, 2017

2:08 AM

Updating Watchlist as more plays show up (Last update: 8:52 AM)

Stocks included in this list:

ZPAS, LWLG, SLTK, WTW, HTGC, CTL, KTOS, HZNP, WKHS, CDXC, FNBC, DRRX, HSGX, AXSM

===#5 Dip buy panic===

ZPAS, LWLG, SLTK

ZPAS 2:10 AM - potential long after panic, will look to short for The crash as well but likely wont find shares

LWLG (Original plan)- look for the dip buy bounce pattern, very low vol so may be no play

- (Friday plan) Looks like I missed the bounce but there was no vol so no way to play this on the long side, still potential short if I can get shares, some are available at IB at 5:15 AM but im not crazy about this no vol play

- 2:11 AM - potential short into 1.25 resistance or 1.50 resistance

SLTK (original plan) - look for topping action for potential short but likely no shares when its time

- (Friday plan) 5:17 AM - looks like the price action is getting bunchy up here, could be topping soon but no way am I quick to jump on this

- 2:13 AM - wow I nailed both the above plans but did not trade this long or short, I missed the short but I saw this while it was panicking and the panic was not ideal for a dip buy, glad I was on the right track

- Important details about the daily chart: During the multiday runup that began on 4/28 and ended on 5/05 the daily chart shows that this stock never had a snap to red until the crash day, Grittani talks about this pattern a lot in his archived Webinars, when the stock finally cracked red it was the end, I will start stalking this pattern more closely.. High odds setup

(Be very cautious with OTC longs many getting halted)

===Other long opportunities===

WTW, HTGC, CTL, KTOS, HZNP

WTW 2:22 AM - earnings winner, if this continues to hold onto the $21 area the pattern can still be intact and have a delayed run off this consolidation, tends to have this retrace pattern on the daily chart before continuing its run (see Feb 28th Gap up)

HTGC 2:25 AM - my gap down strategy I detailed in this video lesson https://profit.ly/500Dms I think this can still follow the pattern im looking for or a weak open red/green

CTL 2:47 AM - my gap down strategy I detailed in this video lesson https://profit.ly/500Dms or a weak open red/green

HZNP 8:35 AM - my gap down strategy I detailed in this video lesson https://profit.ly/500Dms

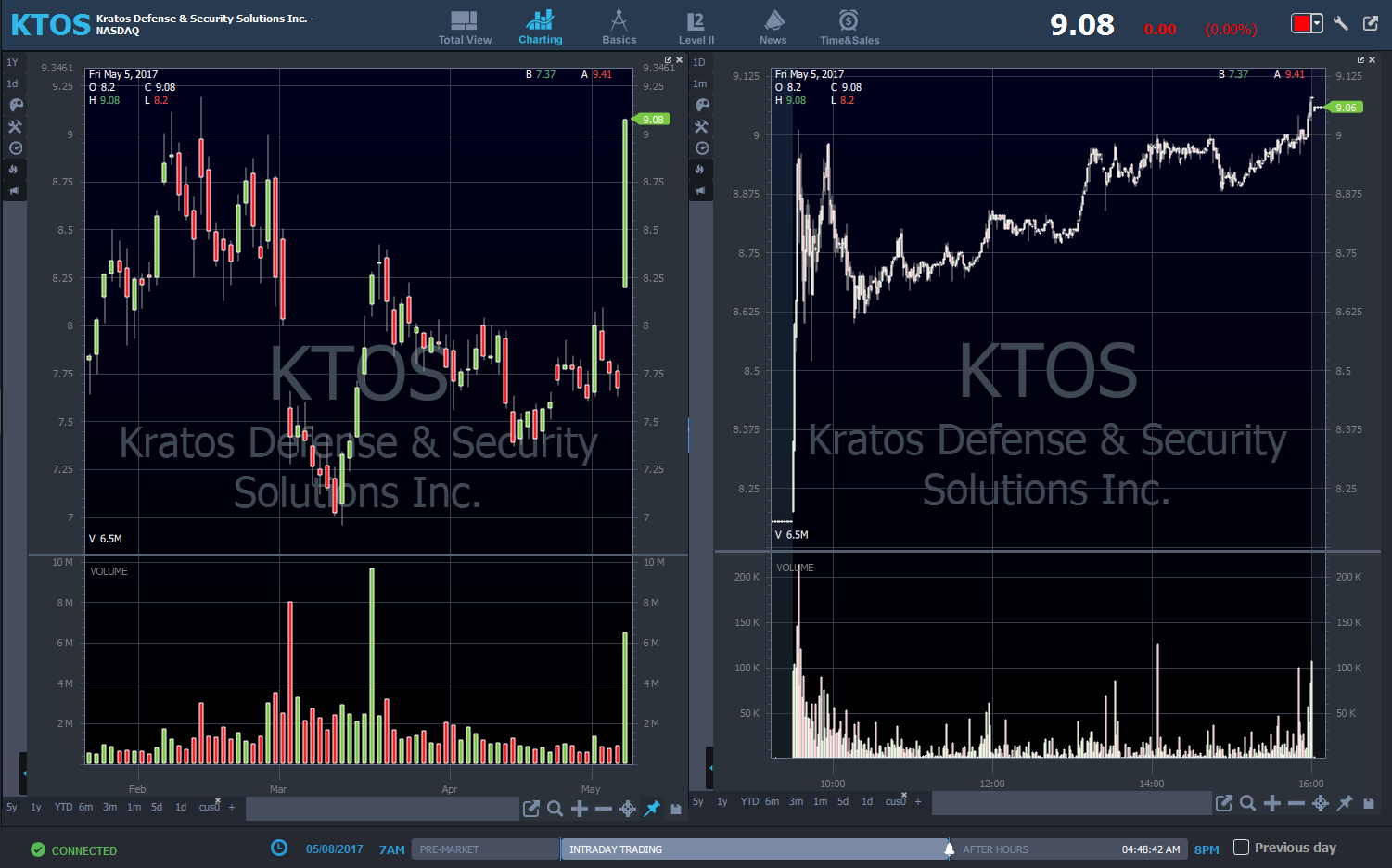

KTOS 4:46 AM - earnings winner potential long on weak open red/green or a break over 9.20s long term resistance

===Short plays===

WKHS,

WKHS 4:50 AM - potential short on crack to red or short into 4.50 resistance area risking on fridays highs

===Swings===

I don’t play swings much, mostly for those who view my watchlist

XXXX,

XXXX 0:00 AM - plan

===Backburners===

CDXC, FNBC, DRRX, HSGX, AXSM

CDXC 2:48 AM - billionaire play, could offer a long on weak open red/green or ideally a morning panic to low 3s for dip buy

FNBC 2:50 AM - my plan played out perfectly on this last week, plan was to buy the .35 cent breakout on the big run day, didn’t trade because I am not good with cheapies, still on backburner watch to see how the delisting goes, likely no trade but interesting to watch, would only short but likely wont find shares

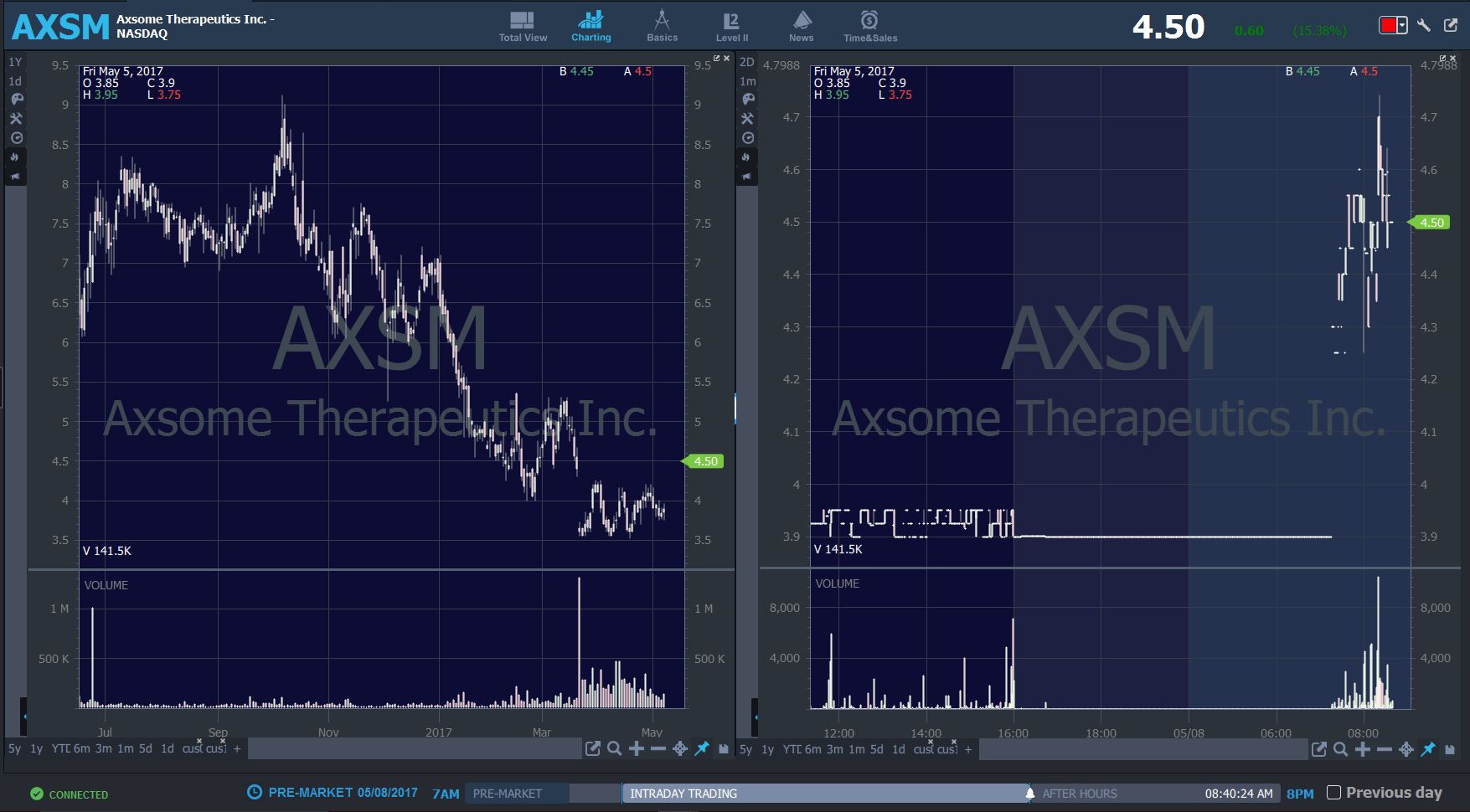

DRRX, HSGX, AXSM 8:17 AM - all of these are ugly/messy longterm charts, my type of play would be to let these run as much as possible then I would reevaluate a short play, would not long any of these..does not mean they cannot run, bias can change if price action proves they are worth my money

MAIN: $KTOS, $HZNP

===Notes===

Very well done

fantastic watchlist, thank you

Thanks

I like this, nice job!

Join now or log in to leave a comment