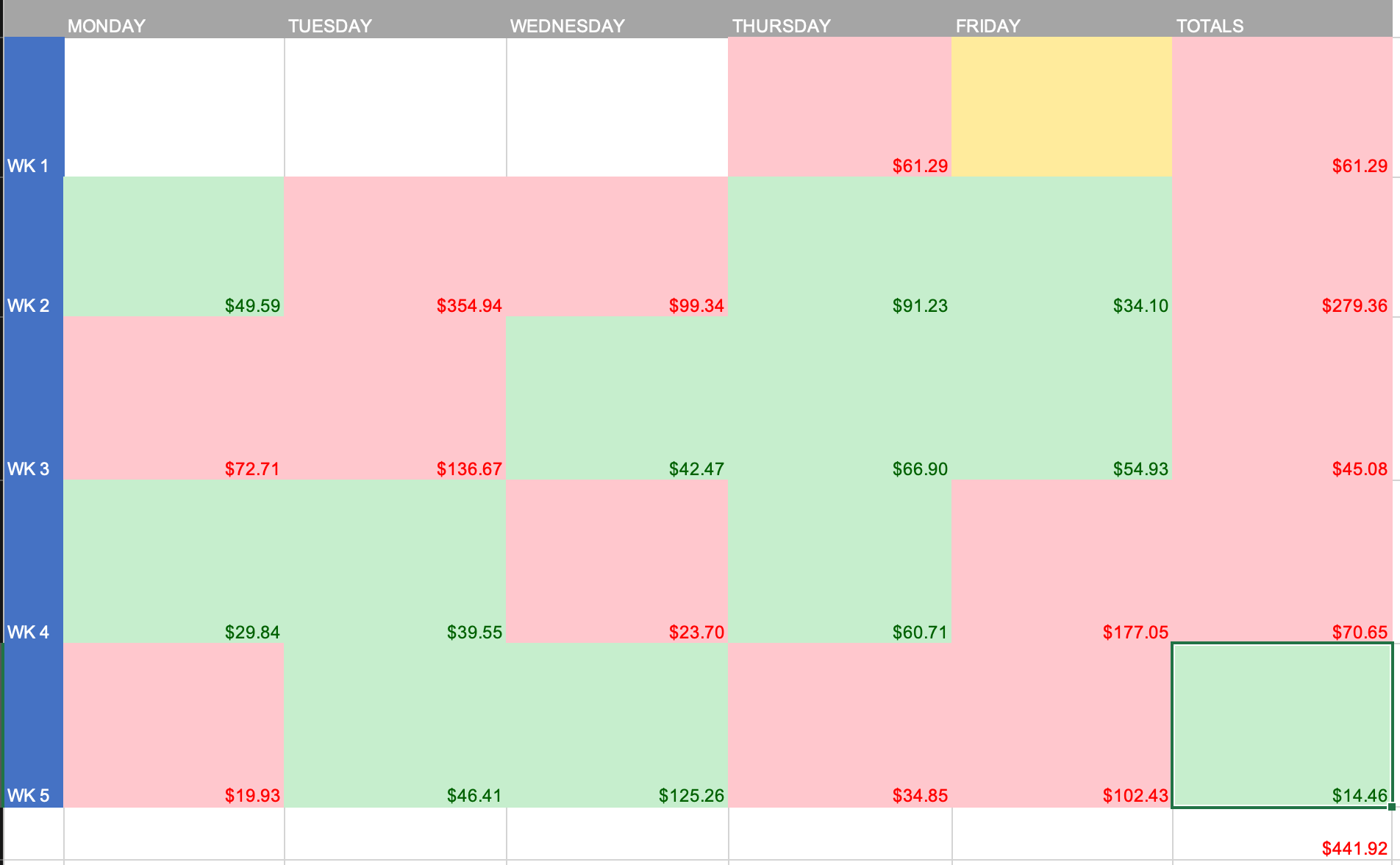

April was a month of a lot of lessons. Some of the lessons I learned this month have really started to shape my trading style. In looking at what has been working this month it is very clear my best set up right at the moment is afternoon breakouts followed by morning intraday HOD breaks. As I sit an start to analyze things it is clear where I need to focus my trading at. First thing is first, I have taken a couple steps back over the last couple months and have been red on both months. I attribute this really to two things this month. One, trading illiquid stocks (either illiquid when I entered for a setup I have been trading well OR illiquid because it is midday) The other is following trade alerts in the Tim Challenge chat. Both scenarios cost me some big losses this month and I really don’t know why I do it., especially when the trade alert I am following is from a new member to the chat. I also think April was carved out by couple pretty bad trades and losses that were just too large. So this month, I am setting a goal to only trade the two setups that I am consistently profitable in right now in this market… Afternoon breakouts and morning HOD breakouts. I have afternoon breakouts honed in on but the morning breakout has been a bit trickier. I have noticed that often times I try to buy the AM HOD break a bit too soon and don’t let the ticker consolidate for long enough before buying into it. The key that I have noticed recently is to buy the morning HOD break after higher lows and higher highs after a pull back to consolidate AND a volume perk comes into play. This presents the best risk to reward rather than just buying the actual breakout itself… I also am a little less likely to cut losses quickly when I buy the actual breakout based off my trading style right at the moment. So when buying these this month I am really going to focus on the HOD breakout in the AM to be on something that either is a day two runner breakout out past the days highs after a gap that sold off but held green OR is an actual spiker (hopefully with news…) that pulls back and consolidates a little bit and makes higher lows and higher highs and has a burst of volume coming in. Successful ones can be traded in the afternoon again if they consolidate near highs so this is a setup that can honestly be really lucrative for me. My next big goals I need to really focus on is trading better risk to reward setups. I think most of my trades right now are more 1 to 1 and at the very least they need to be 2 to 1 and 3 to 1 is ideal. My account is basically sideways this year because I am not trading the best risk to reward setups right now AND I am not cutting losses fast enough/facing one big loss on the month that really sets me behind. So in summary I need to focus on avoiding illiquid setups (midday or low volume any other time of day...) while sticking to AM HOD breakouts and afternoon breakout plays. I will work on my risk to reward setups this month specific to these setups and honestly I have decided to size up with afternoon breakouts. I win almost 80% of the time with this setup so I think if there is a time to size up on anything it is going to be this setup. Will actually be sizing down to a $35 risk on morning breakout setup but will be increasing to $100 risk for afternoon setup. This is going to force me to really look for A+++ setups only and I think the larger risk will force me to keep a tighter leash as I don’t want to lose $100/trade.

Join now or log in to leave a comment