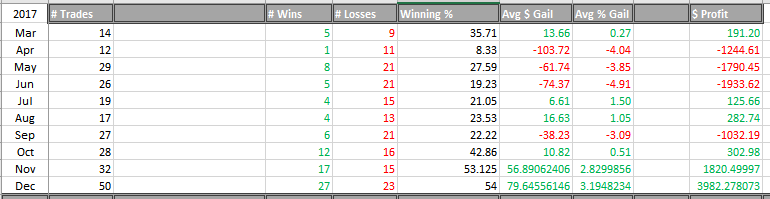

I started trading in March 2017 with 3K (added later 3K and another 1-2K, and I live in a country that average pay is about 800$/month so this is already big money for me). I was in red for first 8 month, down 5,5K and was near blowing up my second account (I would probably have to quit trading for some time, because I would be broke and I would have to look for a job again), but manage to get myself together. Last 3 month I am green and in just last 2 months made back almost 6K and now I am back to positive 0. I think my trading is actually a little better than before, but we will see how the next year goes, maybe this was only lucky run.

So I decided to write my 1st post, in case it can help anyone. I know it is a long one, but I think it would help me in my beginner stage. I am under PDT and I use IB.

I watched about 90%-95% of all TIMs videos, also all DVD (I didn’t watch webinars from TIMs challenge, I am only silver subscriber), Trading Tickers (very good DVD), all Nate DVDs (from investors underground, this are very good also), listen about 15 audiobook, and read about 5 books. Some of DVD watched 2, 3 or even 4 times. I also write a diary of my trades and weekly review. But I did this already in my first 8 months, when I was losing money, so I can’t say that if you do all this it will make you money, but I also can’t say that it didn’t help me.

I probably struggled will ALL of the mistakes that noob trader makes (and I still do with some of them). And I mean ALL of them. Chasing, discipline, too big size (emotional trading), not cutting losses, becoming a bag holder, didn’t do my DD, got emotional because of the news (trade the price action not the news), tried to follow chat alerts, greed, entering pre-market, wanted to be the first in the news…..

I think that every profitable trader, can say that the biggest problems for most of beginner traders is mindset/psychology. By this I mean emotions, discipline, thinking how easy it is to be a trader…. And I know that a lot of you will say, no I don’t think like that, believe me I thought that to for a long time, but this problems can; and probably are; subconsciously. You probably think: “90% of traders lose, because the give up, but I won’t” or “My trader are not emotional, because I was warned so many times, by Tim S. Tim G. and others, not to get emotional” or “I am not an addict I just have to trade and trade and trade and I will get better with experience (but if you don’t change anything you won’t get better)” or even “I think I have something other 90% doesn’t have (maybe good pattern recognition, maybe I can be on PC for a lot of time, or some other superpower…)” But in the end I think it is all about mindset/psychology (when you have strategies to trade) and hard work off course.

Self-awareness is the key here. I think that if you want to succeed in trading or any other business you have to be self-aware as much as possible. Why are doing what you are doing? You have to ask yourself regularly (out loud before you do it, is the best): “Is this really a good trade?” - “Is this really a good entry/exit” - “Is this really my kind of play or am I going in just because someone alerted it” - “Am I an addict (this is the funny one, because I think a lot of trades are just an addicts (I was also an addict in the past, playing poker, not knowing a thing about poker, in collage losing about 1K))”…

So how did I get just little better? First I can tell you that if you are losing trader there is not just 1 thing that can help you. You have to do a lot of things together correctly , probably more than 10, idk (you can still miss 1 or 2), didn’t ever count, but the point is, that you shouldnt be searching just for 1 thing that you think it will change all in your trading. Well I started to ask myself all this questions. I am just a gambles, or didn’t I learned something from my past trades/poker mistakes? Do I trade just like a noob?, Do i chase? WHY do I chase?….

So what were my biggest problems?

1. OVERTRADING (trying to get next big runner - I struggled with this from beginning, and still do, but much much less.

Now I completely ignore big morning spikers, because they did a lot of damage to me. I am not saying that they are not good to trade, but I think they are not good for beginners especially with PDT. Buying morning HOD b/o was probably responsible for losing my first 3K account.

(remember how many times TIM sad on his trades in DVDs “you could just buy HOD b/o”, but when you follow his trades he never buys HOD b/o, he always buys the dip, but of course it was my fault, because I also didn’t do other DD, wrong market, didtn know how stuff move looks like, didnt cut losses quickly,... and just bought every HOD b/o on stock that had volume, I am just saying be careful. Because I heard it so many times, I just though you can buy every HOD b/o)

- First thing I did after just couple of months in chat is, that I “whitelisted” just few of the traders that I think I can get some help from. I have just gurus and about 20 other traders, because I know that 90% of traders are just gamblers, yes even in this chatroom I think 90% of traders loos in a long term. I wanted to see only the traders that can help me, because I was to influenced by everyone else that were chasing and by accident made 1000$ and thought they knew something. So I became one of them and made some big gains, but lost even more, so I had to cut the noise from the chat. It also applies for Twitter, I have only about 10 people on my TweetDeck. Will probably add more by time, but for beginner trader it is important to cut out the noise.

- I also made big losses in premarket and after hours trading, so I am trying not to trade, even if the trade looks perfect, because I know that if “they” want to trick us, the easiest to do it is on low volume price action.

2. Emotional trading – I think this were most important changes in my trading, because only in last 3 months I am doing this and results are good.

I think the biggest problem was that almost all my trades were emotional, but unfortunately I didn’t realize this for first 8 months, even if I was warned by all of this many times before, from our “gurus”. Here are some examples of emotional trading.

- To big size. How many times did you hear not to play too big sizes? A lot right. I heard that from almost every trader’s interview, video or a book, but I still went almost always all in because of my small account. I thought that if I wanted to get some profits I have to go all in on so small account. Big mistakes. Because of that my losses were way too big and every 200-300 loss I think it made me almost depressed in a way, and because of this all my next trades were emotional (wanted to get back, didn’t want to missed next big runner...) Find out with what max loss you are comfortable and multiply that by 10 because you can easily have 10 losses in a row. My loses were max 200$, but later I realize that I was comfortable with only 30$ losses. So lesson here is, don’t ever think about potential gains, focus ALWAYS about potential losses.

- Size management. Do you enter in every trade the same $ amount? Don’t do that. Instead manage your $ size based on your risk and not on % (this is because all stock have different price range and some are moving quickly some slowly). What do I mean by that? Example - Do not go in every trade 5000$ and risk on every trade 5% (or whatever other risk size), instead 1ts know what your $ risk is, let say 200$, and that go in to a trade, with that $ amount not %, that if your stop is hit, you won’t lose more than 200$. So if you would go in trade 0.1 from your risk, here your max size should be 2000$. So more close to your risk you enter, the bigger size you can go in a trade. I know that TIM G. is talking about this in his DVD, but again, I didn’t think it was so important. My thinking was that you can go always 5K and you just risk x%, it is basically the same thing. But you could not believe how much of a difference this makes. Try it.

- PDT. PDT rule is a bitc*, but you have to learn to ignore it. Better to lose a trade than made 10% loss, every time. (there will be many more trades to trade, but you cant get your money back for free). Try to have a strategy that you can trade less rather than a lot (so no morning spiker, because there are just too many of them and you will probably spend all trades in 1 day) and try to have a mindset like you are not under PDT. Self-awareness - always ask yourself if you are still holding because you don’t want to lose a trade or because price action is still good. Also try to open more than 1 account, so you can have more than 3 day trades. I now have 3 account and it is a huge huge difference for me.

- Daily P&L. So many time I hear say TIM G. that one of the first things he did and that helped him, was hiding your daily P&L. I removed it from my “recent trades” window but I still had it under my portfolio. I didn’t think it had any influence on my trading since it was hidden and I could see it only if I clicked on my portfolio window. Boy was I wrong. Here we are again, emotions are controlling my next trades. I didn’t look at P&L when I was in a trade, but I looked it after when I was out of a trade. That still damaged my trading, because I wanted to make back my losses. I thought I was safe, but I wasn’t until I asked myself why do I even look at my P&L? It doesnt help me and I definitely wont trade any better if I look at it. Focus on the chart and PA instead. Since then I only try to look at it at the end of the day.

Now of course I still have troubles time to time with some of this, and maybe I was even just lucky last 3 months, but I also have a feeling that I trade little better. Most of my profits came from SS and not playing BTC stocks, what is contrary to current trend. I know I could write much more (how to focus more on big picture, try to be smarter than all other noobs (not be part of the crowd)), but this is already too long of a post for most of people. Maybe next time.

Not the best writing, but I think it will be OK for the firs post.

Happy new year and wishing a lot success in next year.

31.12.2017

@Kody I understand that is really hard to be happy with only 3% gain on 300$ position, but this is the way to consistency. You first have to find patteren that works cosistantly for you. Because when you will have big account 3% gain will still be good "break even trade" and 10% gain will great trade. All I am trying to say don't focus to make 10% every time, better less gain than a loss. At least try it for 2 week and see if it is any difference in final result.

Good work, and congrats on making the come back! Thanks for sharing, hope you keep at it to get profitable.

@wannabestocktrader Ty. This post was actually from end of Dec, I just edit some words today when I read it again, because I had bad month in March (-1,5K$). Trying to learn to trade NASDAQ but it is very hard for me. First red month after 5 green, but manage to get better in last 2 weeks, we will see what will I do in April. Will update soon.

love the transparent insight. I completely understand what you mean by cut out the noise in the chatroom. The challenge chatroom definitely cuts a lot of the bs

Join now or log in to leave a comment