My scans this weekend are showing me a good bit of stocks that are setting up to make some decent moves this week, assuming the market holds up. Last week /ES began bouncing off of support around 2036-2040, and a double-bottom around that level may potentially be developing. Be cautious though because we also just saw a double-top pattern around 2110 as well. We had lots of winners the past couple of weeks! IG was a perfect bottom-bounce play and went to 9.50 from my alert in the low 8s. GNCA, which was one I really liked, and one I like moving forward went to 12.50 from 9.90 alert. This weeks watchlists consists of long plays, as I anticipating the market will be relatively strong. So here we go..

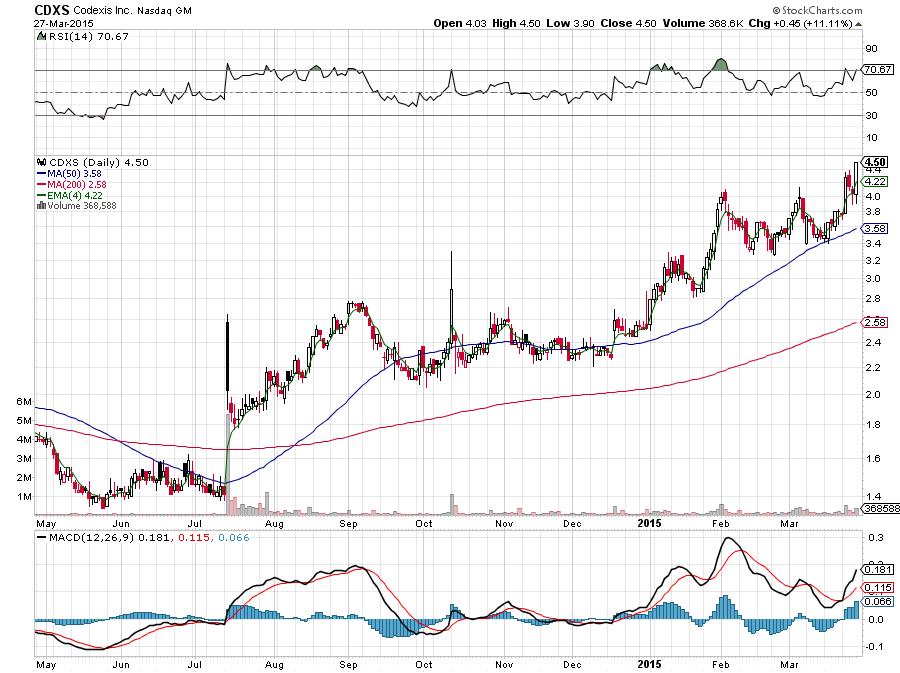

CDXS is one that has been running strong since the beginning of the year. Although it is up nearly 100% this year, I think the momentum may continue. If you are looking to play this one, it may be more of a one to two-week hold in my opinion. Don't rush an entry Monday morning, as this made a strong move of 11% on Friday, so watch for a potential pull-back to the 4.30-4.35 area. As long as volume and the RSI remain strong, I see this moving higher.

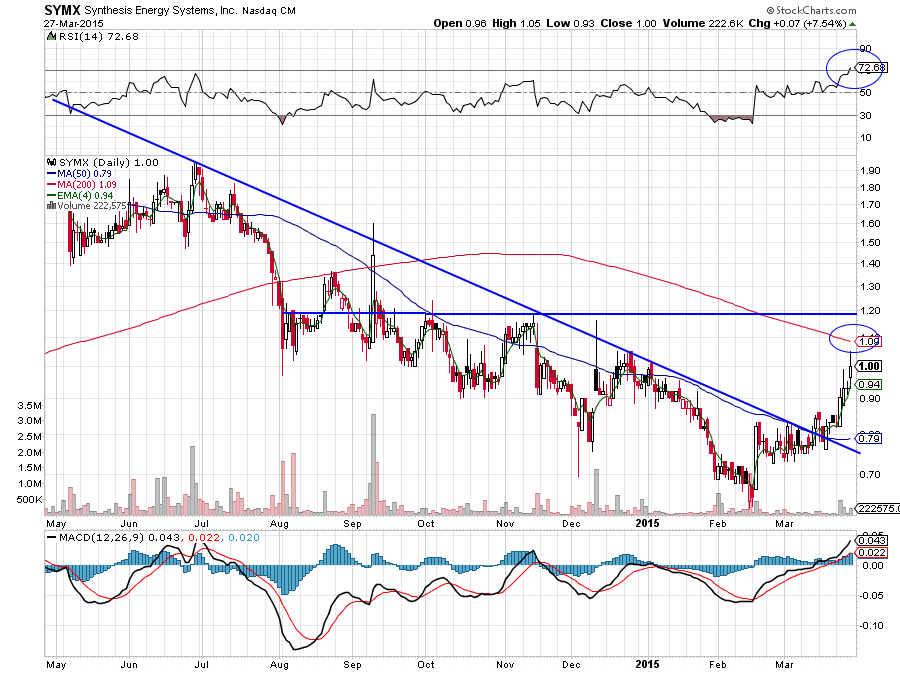

SYMX recently broke a downtrend line that dates back to last March, and is now moving higher. Momentum appears strong, and this is creeping up on some resistance levels around 1.05, as well as the 200-day moving average at 1.09. If this can break those resistance levels and then bust through that 200-day, and then move through some more resistance around 1.17, I think this could quickly move somewhere between 1.35-1.50 per share.

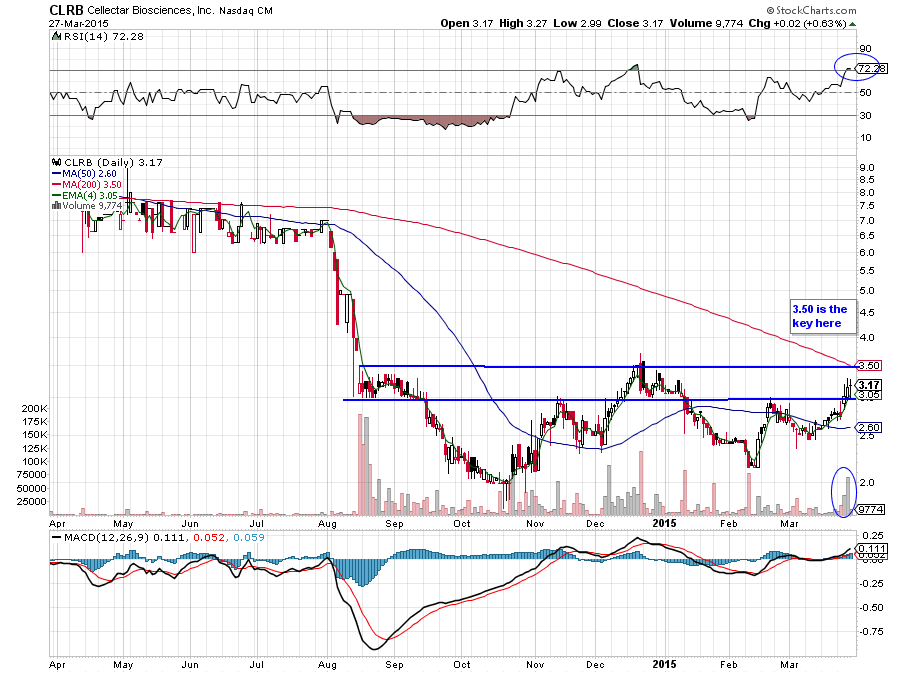

CLRB is another one that is moving into breakout territory, and I really like this one, and I think it has a lot of potential. CLRB has been uptrending lately, and last week it broke out of some resistance around 3.00. Volume has been strong, RSI has crossed above 70, and it is approaching its 200-day moving average which is sitting at 3.50. I think 3.50 is the key level here that triggers a major move for this one, because not only is that the 200-day moving average, but we also have the most recent resistance sitting there as well. If you decide to play this one, be cautious because the float is about 6.5 million. If this works, my target would be 4.50-5.00 per share. My stop would be the first support level around 3.00 per share.

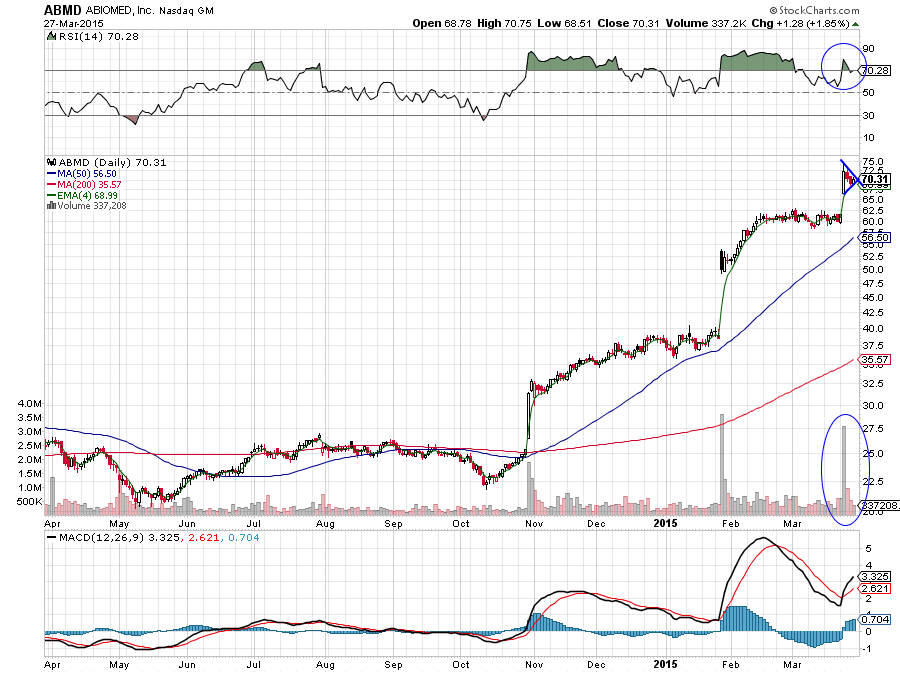

ABMD has been ridiculously strong the past six months, moving from 25.00 per share in November to its current price of 70.31 per share, and also making multiple gap-ups in the process. This made a gap up last week on huge volume, and then pulled back some the rest of the week on light volume, until finding some support on Friday. I think maybe this one is ready to run again after resting a bit, and I am looking for anywhere between 75.00 to 80.00 per share. My stop if it doesn't work would be Fridays low of 68.51.

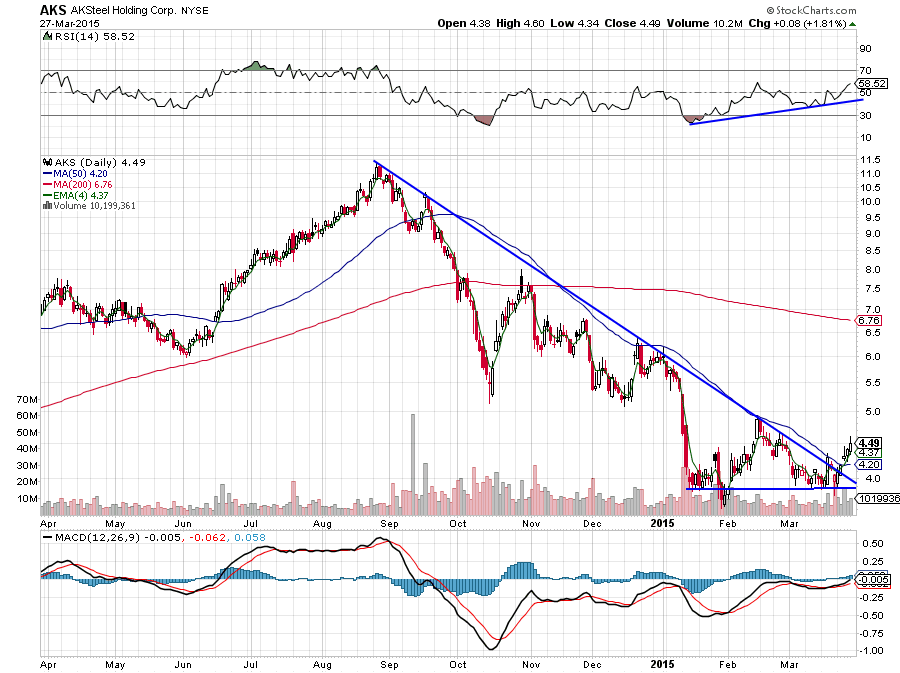

And lastly is AKS. This one has recently broke out of a downtrend line that dates back to last September, and is moving up on above average volume. The only major resistance level that I can see is around 4.80 to 4.90 per share, and if this can break through that I think it could make a move to 5.50 to 6.00 per share. What I really like about this one is that the short-percentage is 26%, so I am looking for a short-squeeze here. If I were to play this one I would manage my position size according to my stop, which would be around the low 4s.

Hopefully we see a bounce in the markets this week, and these ideas work. Always remember to do your own analysis first and understand your own risk management. Don't forget to follow me on Twitter and StockTwits @ChampionTrades to get alerts and more ideas!

Happy Trading!

Join now or log in to leave a comment