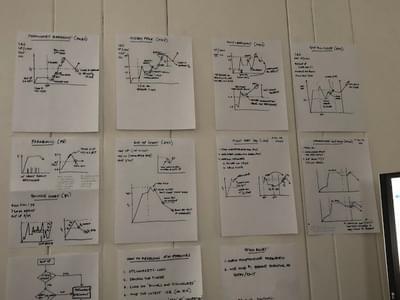

End of another month. I'm still not profitable, but I can see my progress and I feel like I'm getting better in ways other than my account size. 1. After initially trying out many different patterns, going short initially, then adding longs, about 2 1/2 months ago, I decided to narrow my focus down to only longs, ideally low float, low market cap, stocks with a catalyst and high volume, first green day, premarket breakout, midday perk and/or multi-time frame breakout patterns, entering on a dip or breakout. 2. By focusing on this specific type of trade/stock, I can ignore everything else, no matter how tempting. I end up only making one or two trades a day. This has been great at keeping my losses small. 3. I make complete plans, from entry, stop loss and profit targets, which I follow no matter what. Even if the plan is a bad one, I'll follow it because my plans always price in a max $ loss value. 4. I keep a journal of all my trades, especially noting my mood during the trade, the setup, what I did right, what I wish I did and NOT on what I did wrong. I realize that if I talk about what I'm doing wrong, I will keep doing that, but if I focus about what I did right and what I WISH I did, I start doing those things. 5. I've accepted that right now I suck at trading profitably, so I no longer feel bad about losing on a trade. I expect to lose (for now). I used to worry about my win rate, my profits, which affected my psychology. 6. Because I have such a terrible track record, I have cut my size way down. I only risk $5-$20 per trade now. With interactive brokers, it's only $2 per trade round trip. I'm not focused on profits right now, but on whether I make good trades. And by keeping my size small, it's buying me time and preserving my capital until I become profitable. After a year and a half of trading, and 185 trades, I'm down less than $1400. $1400 for two years of grad school is a bargain! 7. I find I'm more relaxed now that I've decided to completely follow my plan, good or bad, and not worry about winning or losing. Since my size is small, I am also not stressed about losing during a trade, and I can focus on the trade. I know that no one trade can make me rich, but one bad trade can blow up my account. So if I can't make $100 consistently, then I can't make $1000. 8. I've learned so much from Tim Sykes, Tim G, Mark C, Michael G, Tim B Dux and now Huddie. Currently I am really trying to emulate trading like RolandWolf because of his style of focusing only on longs, dip buys and breakouts. He is consistently making good money using only a few patterns. 9. Another thing I'm doing which has helped me is to trade in a cash account. Since I'm only doing longs, and I'm trading really small size I use very little of my $5000 account. This is beneficial in that I am not restricted by the PDT rule, and therefore don't have to worry about staying in a trade or holding off on a trade. And since my size is small, I don't worry about having to wait 3 days for the money to clear in order to use it to trade. I still have the rest of the money in my account. And since my IB commissions are so low, I don't worry about commissions eating away at my account value. I highly recommend this. It's been almost 2 years since I've discovered Tim Sykes and this niche of penny stock trading. I can see the potential, and even though I've been discouraged so many times, I really believe Tim Sykes and the others when they say that we just need to push past this hard part and not quit. If we can do that, we can turn the corner and become profitable. So I'm still here 2 years later, still not profitable, but getting better. Hopefully someday soon, I can be just like those guys.

Join now or log in to leave a comment