This was the end of my first full week trading with my eTrade account and Stocks to Trade. A few things.

1) I know why you need to have at least 1000 to 1200 to start trading in eTrade. That $13.90 per buy & sell eats your profit. 3 trades I was positive 85.16. After commission, 43.46. Ouch! Hey, it's positive movement. I'll get over it.

2) Stocks to Trade rocks. I've been putting off doing this since I started this journey. I think that makes me appreciate what STT has to offer more. Every trade I have made this week I have analysed on STT. The one loss was a mid-day trade where I should not have traded. The wins were because I did exactly what I needed to do.

Make the investment.

3) Fine tuning

I'll spend a little more on this. I haven't paid for the level 2 view yet on STT. It's an expense I am not quite ready for. To fill the gap, I have gone back to some things I learned when I was taking classes for FOREX.

The biggest thing I learned in FOREX was the momentum. You could see when a pair changed direction, when it was keeping a trend or not. I used the 20 & 50 SMA there and you could see a lot. Strong trend, reversals, breakdowns, breakouts, over extended moves....

I've incorporated that here paired with the screeners in STT. Both my successful trades have been because of this. My opinion. My loss is because I didn't, it was a mid day chase. A no no.

Here are this weeks trades. I would love your feedback. I'm 66.6% on this.

Trade #1 SSC 8/27/18 (My first penny stock trade was SSC also. And it was a win)

After the morning panic, waited for it to settle then turn back up. When the 20 crossed the 50 I bought, set my sell 10% profit and watched. It hit the target early and sold. Could have gotten more, sure. Take the meat of the move.

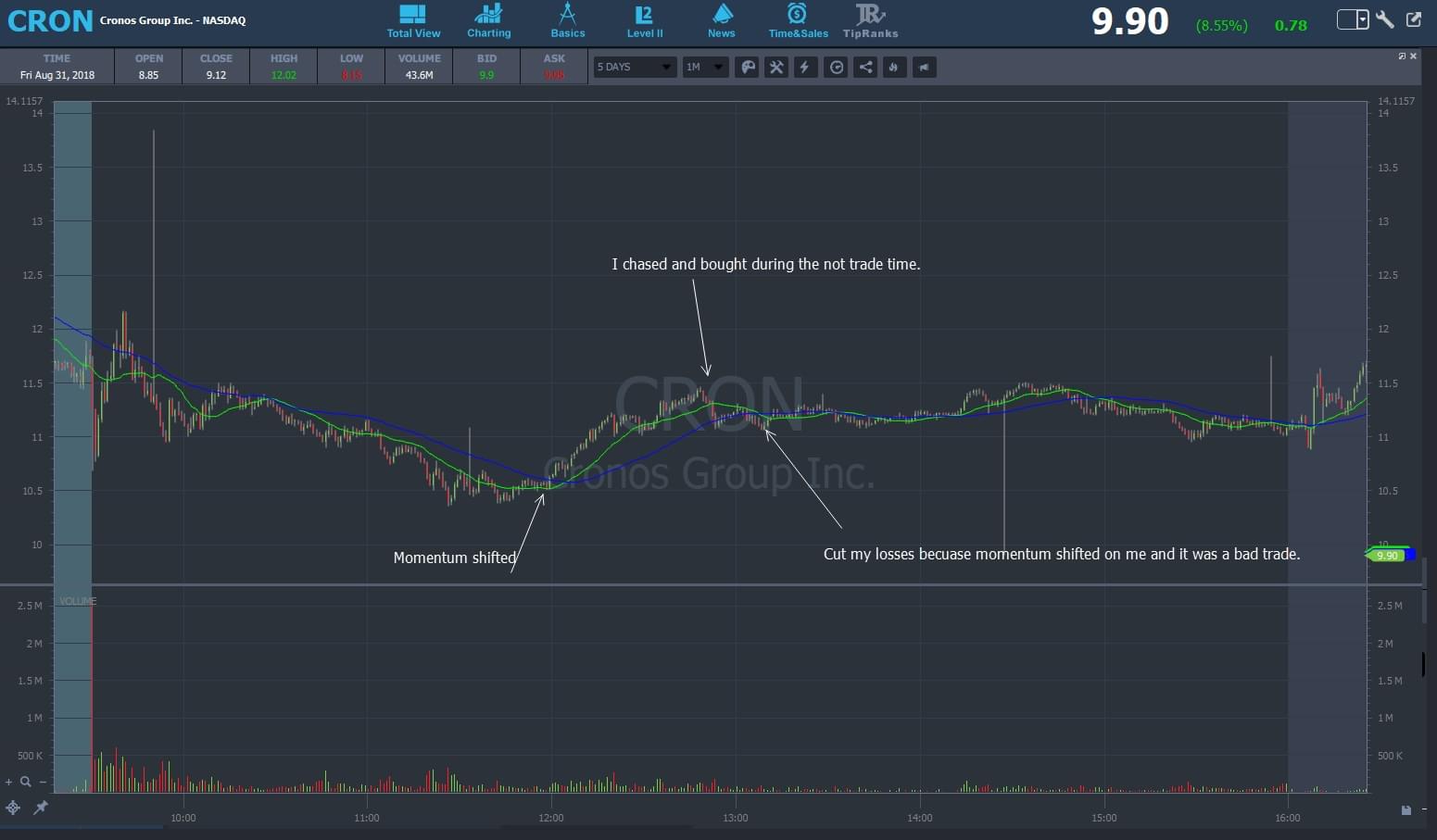

#2 CRON 8/28/18 What I did wrong

First, It was in the no trade time. I should not have been watching anyway. FOMO? If I was going to buy, I missed the time to do it and chased. Did good? Got out.

#3 AMRS 8/30/18-8/31/18

This was a first green day that had strong momentum going into the close. The plan was to buy then sell on the morning spike. There wasn't really a spike. It slowly climbed through the day so I let it go. Got out at the end of the day because I didn't feel comfortable holding over the weekend. Maybe dip buy Tuesday?

I didn't notice the strong buying at the end of the day.

I would suggest not trading the stock higher then $5-$6 as I see you have a small account , I’m not saying don’t trade them. If there’s a good enough opportunity go for it , but otherwise stay away.

If you make let’s say 0.20 on a $3 stock with a position size of 500 shares you make a quick $100 - fees around 70 bucks I would say not completely sure...

Tracking your trades good! :)

@bram101 Thanks. I've been tracking since I began. Doing more in depth analysis now that I have STT. Most stocks I'm looking at under $10. With $CRON being in a hot sector, I don't think it's a bad idea to keep on my watch list.

Join now or log in to leave a comment