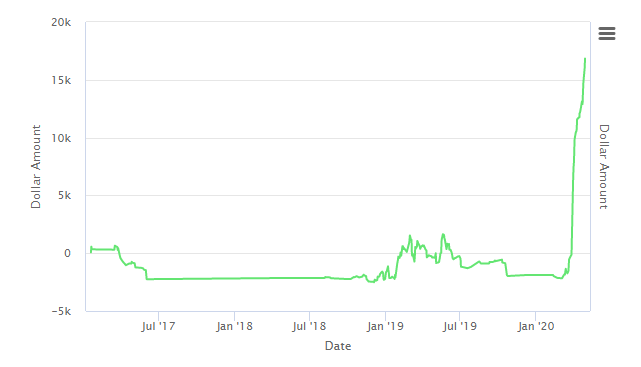

I know all the gurus say it all the time, but you really need to track data for yourself and analyze your trades to find out what really works and stick to those 1 or 2 patterns. At the same time, its easy to hear something and then stare at a moving chart and feel the need to jump in. Since 2017 I would constantly go back and forth jumping from "pattern to pattern" or following other peoples alerts until I got sick of wiping away gains from a couple good trades to having a blowup trade that wipes out all the profits. This is a result of finding almost literally 1 pattern and sticking to that, so don't feel the need to try to get in on every pattern you can. Once you find a solid pattern that works for you after tracking the data yourself, you can slowly scale up in size to grow your account.

The main few lessons that I have learned with finding a little bit of success is to have a set risk of how much you're going to lose in the trade if it doesn't go your way. You have to be 100% okay with how much you could lose. Next would be to never chase a stock. All of my biggest losses have come from either not cutting the loss where my risk was or chasing a stock. I also believe that those 2 go hand in hand. If you are chasing a stock its very likely that you don't have a risk level at all or don't have a very logical risk level. From tracking my trades it has also shown me that often times I didn't have the correct risk level in mind because I had such a tight risk, just to see that the ended up going my way and it would've been a profit.

Learn from your own patterns and behaviors as a trader.

good points in this post. I'm gonna listen and apply to myself. thanks for spending the time to post.

congrats bro

Congratulations - a great achievement indeed.

thanks bro for this advice . this changed my trading game forever . thanks so so so so much!

Join now or log in to leave a comment