a. Pattern 3b short BUT stock is in uptrend ie 50 dma > 200 dma and price > 50 dma.

b. The "shooting star" candle on the daily chart looks like an arrow pointing DOWN.

c. Watching for a gap up or morning rally and/or red to green to short in to.

d. Likely no play as borrows are hard to find & secure and the sell off is likely to be hard and swift.

a. "Breakaway three" reversal

b. Multi-day resistance @10.1

c. Fading volume.

d. Hype and momentum have died down, now on sell/bear side.

a. Must-day pennant consolidation that is likely distribution based on volume fading.

b. Confirmed downtrend ie 3 consecutive lower lows and highs.

c. Watch for a break and close beneath the 9 dma for additional bearishness.

d. Hype and momentum have died down, now on sell/bear side.

a. Frist break of uptrend (intraday chart)

b. Held support @3.85 and closed with an "in neck line" continuation candle BUT stock has a history of reversing and selling off swiftly ... and crushing bulls.

c. Short on retrace to broken trend line or vwap.

d. Interesting cannabis play but dreadful stock that's grossly overextended and trading around major resistance.

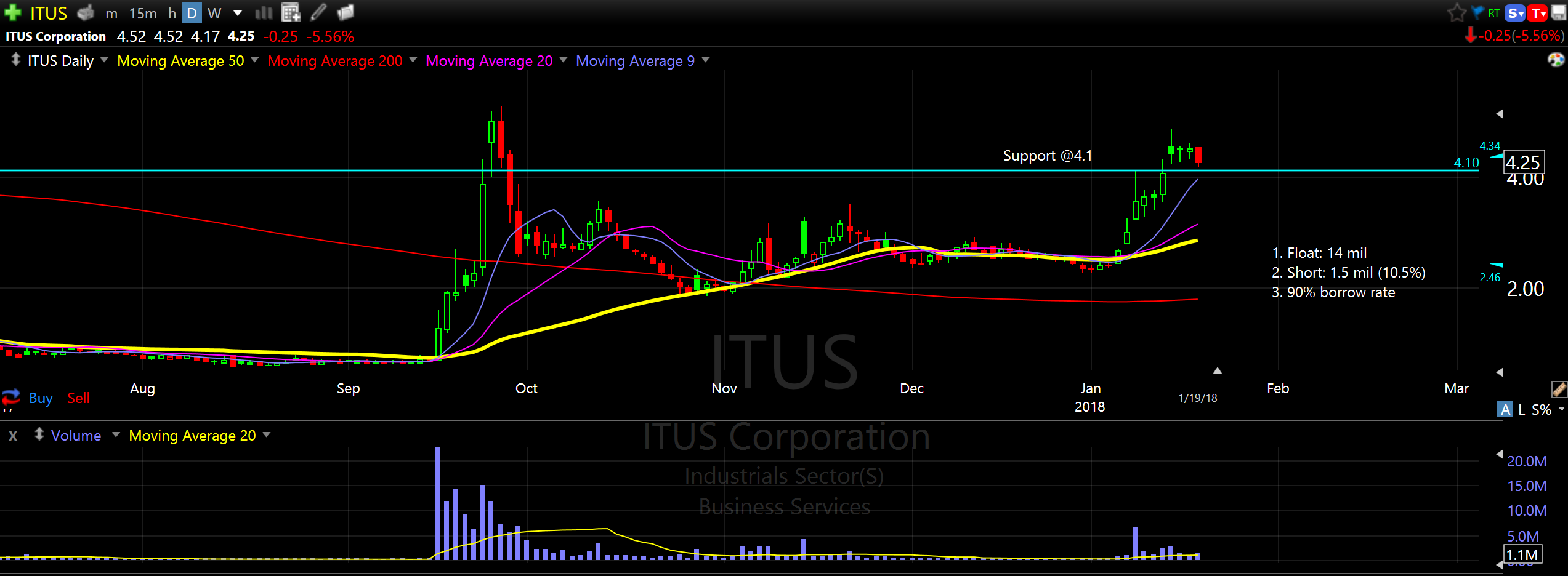

a. "Tri-star" -- rare but powerful reversal pattern.

b. 1st red day/bearish engulfing candle.

c. Volume fading.

d. Watching for support @4.1 to crack to short in to.

a. Volume fading

b. ... "breakaway three" reversal

c. $BTC selling off again (ie $XNET tracks closely with $BTC)

d. Watch for a break of and close beneath the 50 dma @15.92 to short in to.

7. Other stocks I'm watching: (a) $galt, (b) $watt, (c) $nvax.

Join now or log in to leave a comment