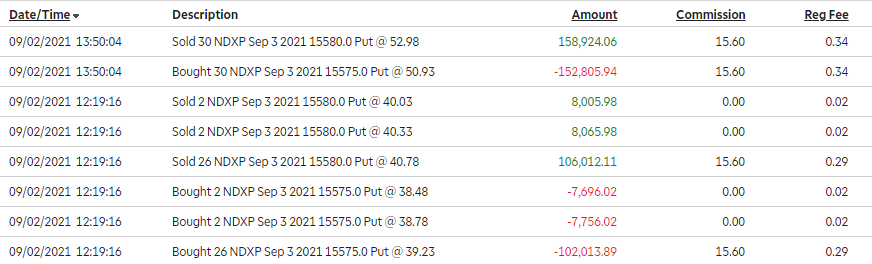

$10,736 Profit

NDXPLong Option

My first Nasdaq bull put vertical option spread. I put in two trades, one for 30 contracts at $1.55 premium and then again for the same strikes at $2.05 premium. Given the pattern, I was confident that the day of expiration would be an upswing. If not, I still had the premiums and I could get another credit for them to roll them over. My thesis was right on the upswing and I banked it all.

Newsletters:TimChallenge

Broker:Schwab

Join Now

| Date | Price | |

|---|---|---|

| Entry | 9/2/2021 | 50.93 |

| Exit | 9/3/2021 | 52.98 |

- Total Views109

- Position Size60

- Percentage4.03%

- Option TypePUT

- Strike15575.0

- Expiration

Copy and paste the following into your page or blog. If using WordPress, you must paste this in the HTML tab only: