-$161 Loss

ROKULong Option

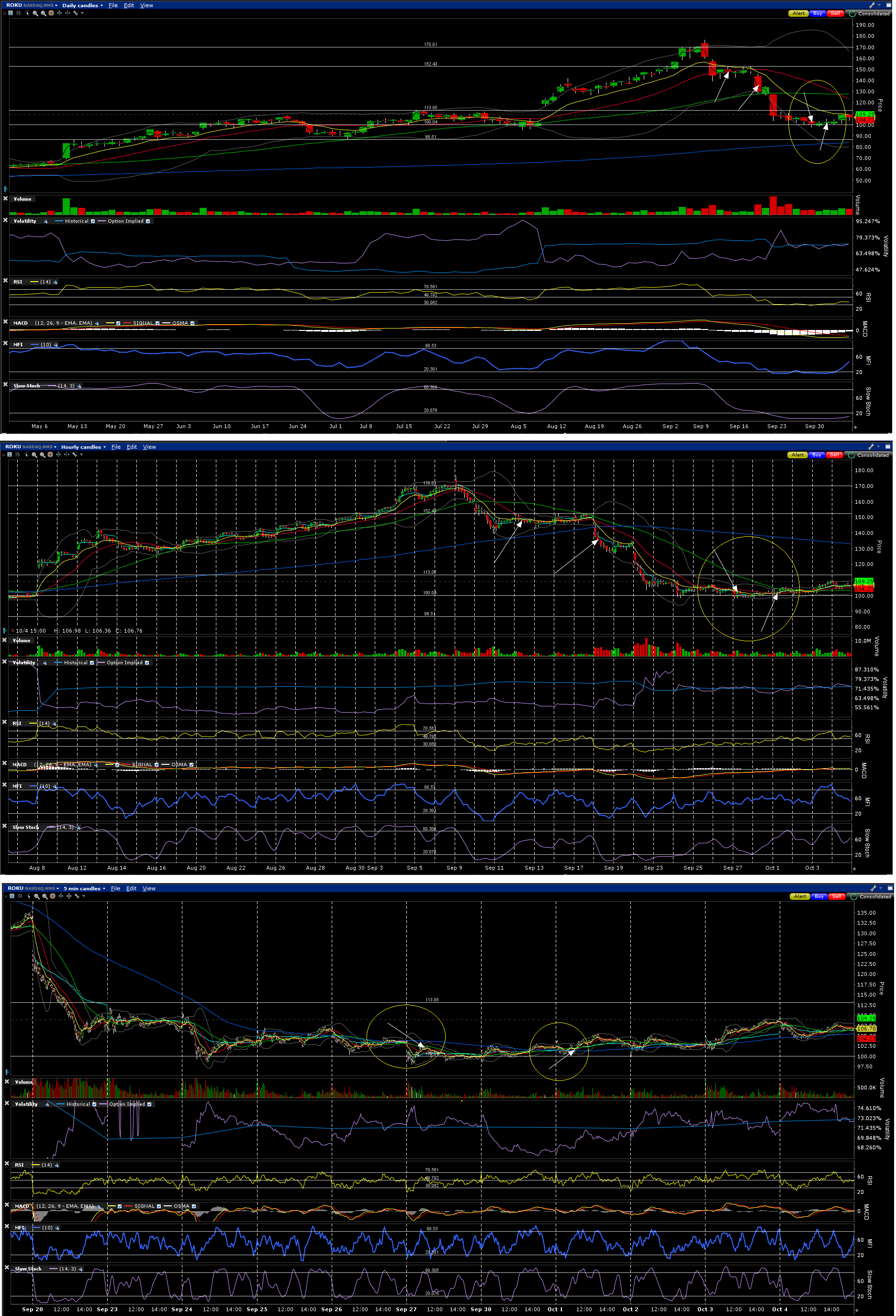

Bought call option when stock was $102,10 and sold it when stock was $101,30... I have bought call option because i was expecting a bounce... Unfortunately i have not stuck with my original plan regarding stop/loss so i ended up cutting loss just 1 day before bounce has happened and now stock is trading even much higher than my profit-target was... I really need to learn not to overthink and just stick with my plan. I often make this mistake.

Broker:Interactive Brokers

| Date | Price | |

|---|---|---|

| Entry | 9/27/2019 | 6.00 |

| Exit | 10/1/2019 | 4.45 |

- Total Views223

- Position Size1

- Percentage-25.83%

- Option TypeCALL

- Strike105.0

- Expiration10/18/2019

Copy and paste the following into your page or blog. If using WordPress, you must paste this in the HTML tab only: