Hi all,

Let me show you the power of selling cash secured PUTS.

I did alot of fundemental research into this company. And with the current selloff create a amazing buying opportunity for longterm investors.

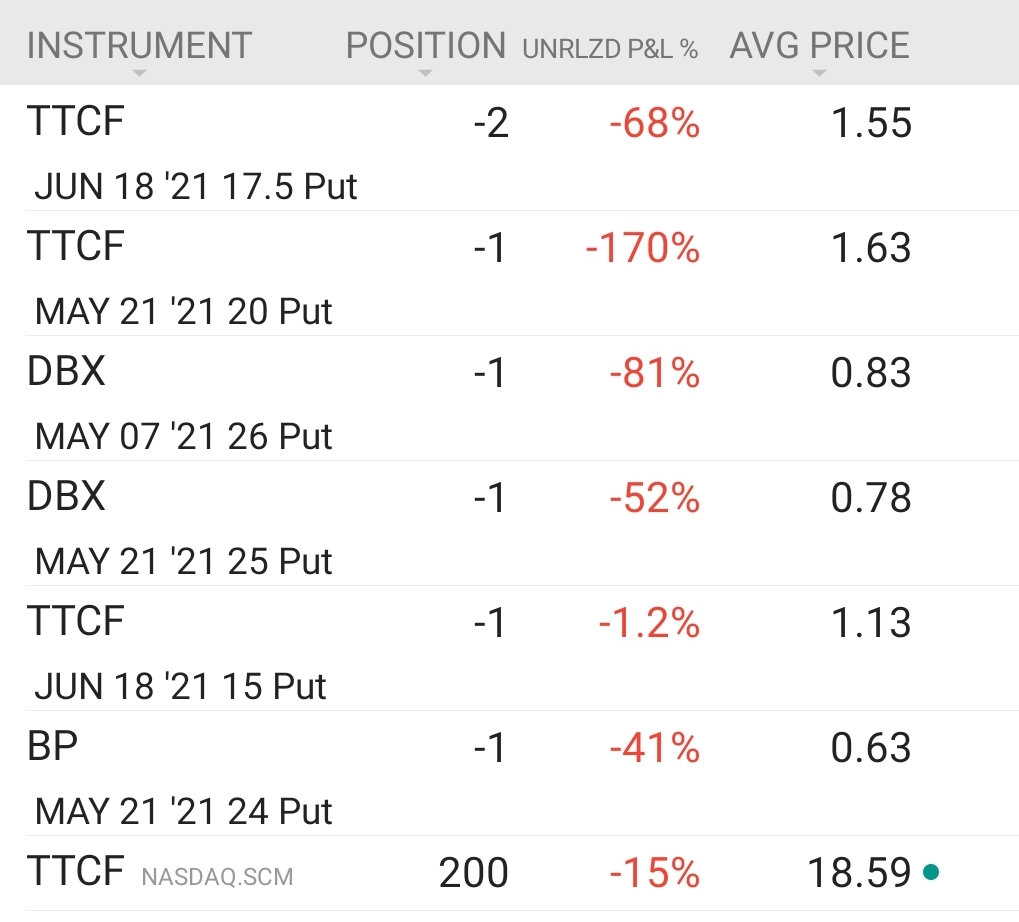

First look at all the contracts in TTCF ( screenshot below ). Don't focus on the red because it does not matter, if you ant to build a position with selling puts. I want to get assigned and then i get to keep 100% of the premium. It's a 100% profit if you get assigned. And remember I aim to keep this position for the longterm, this is not a short term trade for me.

Current market cap is just 1.3B and i aim for arround 8/10B market cap. So i can see this company go up 500/1000% in 3/5 years. The total premium i've received from these puts is +$586 and if i get assigned on all of them my total average will be 17.86 and with the premium received in theory my average will be 16.88. When i get assigned everything i have a total of $10716 in this stock, worst thing that could happen is that i lose $2000/4000 on this investment to make $42000/96444 + i am going to sell far out of the money call options on every spike. Risk reward is great in my opinion. Current market cap is just 1.3B and i aim for a 8/10B market cap.

There is also the posibility the price spikes and i'm going to buy back some of the contracts for a 40/80% profit and reroll and sell new ones little higher to again receive more premium.

Selling puts on stocks you want to own is a great thing and to reduce your overall risk .

Join now or log in to leave a comment